If you own a trucking company, you already have enough on your plate — drivers to manage, loads to move, and tight deadlines to meet. But one thing that can’t be ignored is payroll taxes.

If they’re not paid the right way and on time, you are the one the IRS will come after. Not your payroll provider. Not your accountant. You.

You’ve probably asked yourself more than once:

“Who actually pays my payroll taxes — and how do I know they’re really being paid?”

You’re not alone. It’s a fair question. And we’re going to answer it clearly, step by step, so you can protect yourself, your money, and your trucking company. At Superior Trucking Payroll Service, we’ve been trusted by trucking businesses for over 17 years to handle payroll and payroll taxes the right way — with honesty, accuracy, and full transparency.

Why You Should Never Assume Your Payroll Taxes Are Paid

We’ve all seen the headlines:

Payroll company runs off with a client’s tax money.

It doesn’t happen every day — but when it does, it ruins businesses. And even though most payroll providers are honest, it only takes one bad actor to cause serious damage. Sadly, fraud in payroll does happen, especially if no one is watching closely.

Here’s the kicker: Even if your payroll company messes up, you are still responsible.

They say:

“An employer’s use of a Payroll Service Provider (PSP) does not relieve the employer from its responsibility of ensuring that all of its federal employment tax duties are met.”

In simple terms: Even if you outsource your payroll, you are still on the hook if taxes aren’t filed or paid.

How to Check If Your Federal Payroll Taxes Are Paid

The best way to make sure your federal payroll taxes are really being paid is to check for yourself — and the good news is, it’s easier than you think.

Use the EFTPS Website (Free, Safe, and Easy)

The Electronic Federal Tax Payment System (EFTPS) is a free website run by the U.S. Treasury. It shows all tax payments made using your Employer Identification Number (EIN).

So, if your payroll company is making your federal tax payments, they should show up here.

Already Signed Up for EFTPS? Here's How to Check:

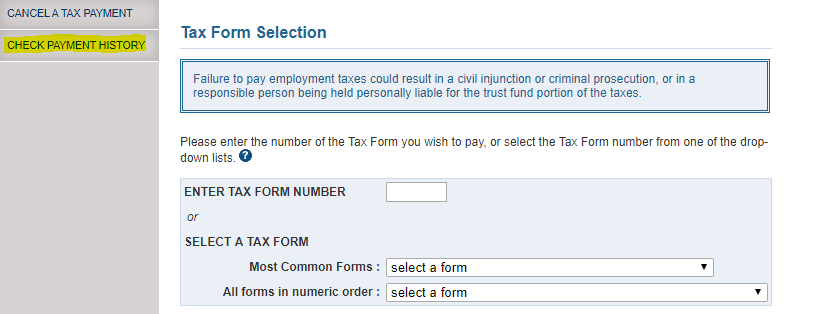

- Go to www.eftps.gov

- Click “Payments”

- Log in with your EIN, PIN, and password

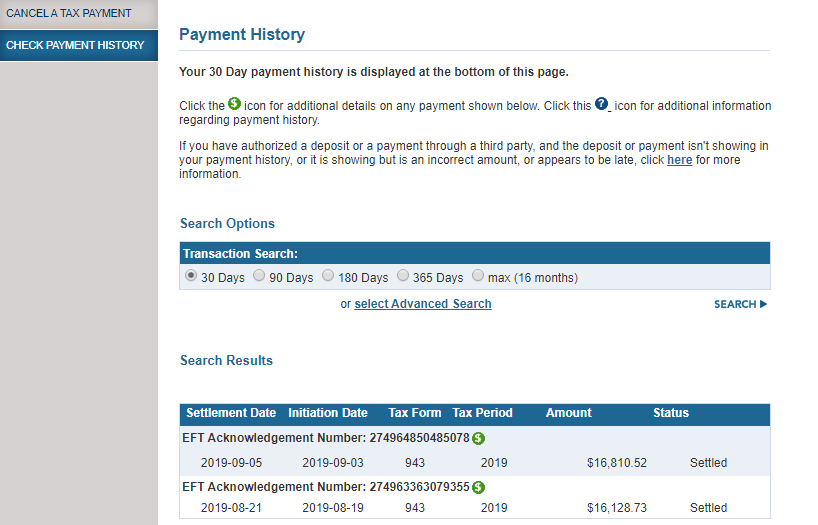

- Click “Check Payment History”

- Look for Form 941 payments (that’s payroll taxes)

Pro Tip: Always make sure your payroll provider is paying taxes under your EIN, not theirs. That’s the only way you’ll see it in EFTPS.

Not Signed Up For EFTPS Yet? Here's How to Do It:

- Go to www.eftps.gov

- Click “Enroll”

- Choose your business type

- Fill in your business and banking info

- Wait for your PIN to arrive in the mail

- Log in and check your payment history, as shown above

Once you’re signed up, you can check any time to make sure your federal taxes are being paid on schedule.

What About State Payroll Taxes?

EFTPS only covers federal taxes. Each state has its own system(s) to handle state income tax, unemployment insurance, and other state-level payroll taxes.

If you haven’t already, ask your payroll provider:

- Where can I view my state tax deposit records?

- Are payments being made under my business account, not yours?

- Can I have login access to check for myself?

What If You Suspect Payroll Tax Fraud?

If something feels off — like missing payments or excuses from your provider — don’t wait.

Here’s what to do:

- Call the IRS Business Hotline at 800-829-4933

- Report concerns using Form 14157: Complaint: Tax Return Preparer

The sooner you report it, the better chance you have to fix it before penalties or interest pile up.

Why All Companies Should Check Payroll Taxes Monthly

Let’s be honest — no matter what industry you’re in, missing payroll tax payments can destroy a business. It’s not just about penalties or late fees. It’s about staying compliant, avoiding audits, and protecting your reputation.

Even if you outsource payroll, you are still legally responsible for making sure those tax payments happen — and happen on time.

That’s why we recommend every business owner and office manager:

- Log in to EFTPS each month to confirm federal tax payments

- Check your state tax portals regularly for any missed deposits

- Ask your payroll provider for written proof of tax filings and payments

Because you’ll know for sure.

Even if you trust your provider, it’s just smart business to double-check. Because at the end of the day, you’re the one the IRS will contact — not them.

How Superior Trucking Payroll Service Helps You Sleep Better at Night

At Superior Trucking Payroll Service, we never use our own accounts to pay your taxes. All payments go out from your EIN and your business account — just like the IRS prefers.

- We help every client set up their own EFTPS account

- We give you direction on how to log in and check anytime

- We give full transparency into every tax payment made

You’ll never be left wondering, “Did they actually pay my taxes?”

Because you’ll know for sure.

What To Do Next

Now that you know how to check your payroll taxes and protect your business don’t wait to take action.

- Already have an EFTPS account? Log in and take a look.

- Need help setting it up? We’ll walk you through it step by step.

- Worried your current payroll company isn’t being transparent? Let’s talk.

At the End of the Day...

You work too hard to let tax mistakes threaten your trucking company. We get how confusing and frustrating payroll taxes can be — especially when someone else is handling it.

Now that you know how to check your tax payments yourself, you have the power to stay in control and out of trouble.

If you’re ready for a payroll partner that puts your business and your peace of mind first, Superior Trucking Payroll Service is here to help.

Reach out today and let’s make sure your payroll taxes are always where they should be — safe, secure, and fully paid.

Written by Melisa Bush

With over 15 years of experience in the trucking industry, Melisa is well-versed in the complexities of trucking payroll and adept at navigating special circumstances. Before joining Superior Trucking Payroll Service, Melisa worked at a trucking company, where she managed driver miles and expenses for a fleet of 50 trucks. This hands-on experience gives her unique insight into the challenges our clients face when preparing their payroll data.