Let's Talk Pricing for Trucking Payroll

At Superior Trucking Payroll Service, we believe in being honest and clear. We want you to trust our payroll services, so we always give straight answers to your questions. Sometimes, questions don’t have easy answers, for example, “How much does payroll cost?”

Payroll services can be complicated, and the cost depends on many things. Our goal is to make things simple for you by sharing details about payroll pricing. This way, you can make smart choices and maybe even save money before you decide to use our services.

- Tax calculation, remittance, and reporting

- 941’s, 940’s, state withholding, local withholding, unemployment

- W-2’s, 1099’s (to the employee & required government agencies)

- AscendTMS integration

- Full and customizable reports

- Companies with 2 or more W2 employees get a free labor law poster.

- Up to 5 direct deposit accounts per employee

- Garnishment calculation and remittance

- Paystubs emailed to your employees BEFORE payday

- Paystubs online 24-7 at www.truckingpaychecks.com

State Tax Set-Up:

- If you set up state taxes when you sign up for our payroll services no fee's will accrue

- If you add an additional state, the fee is $50 per state

- If you need to discontinue a state, the fee is $100 per state

A $15 weekly “missed payroll fee” is charged to keep your tax filings up to date. Unlike other payroll services, there are no extra charges for quarter-end fees or tax filing fees.

Our goal is to make your life easier, not harder. We offer dedicated and personal service, so you’ll always talk to someone who knows your account. There are no strict rules on how you submit data—we work with you to find the best way for your company to submit payroll data.

– When your business has locations in multiple countries under one Federal ID Number. – If price is your main concern and you’re already familiar with payroll laws. – If your company requires picking up paper checks or documents because email isn’t an option.

Trucking Payroll FAQs

Not only do we form relationships with our customers but we make sure that we fit our payroll service to their specific needs. We can customize what’s on your paystub such as; load number, delivery date, the city the driver started in or ended in, or both, or miles driven.

A $15 weekly “missed payroll fee” is charged to keep your tax filings up to date. Unlike other payroll services, there are no extra charges for quarter-end fees or tax filing fees.

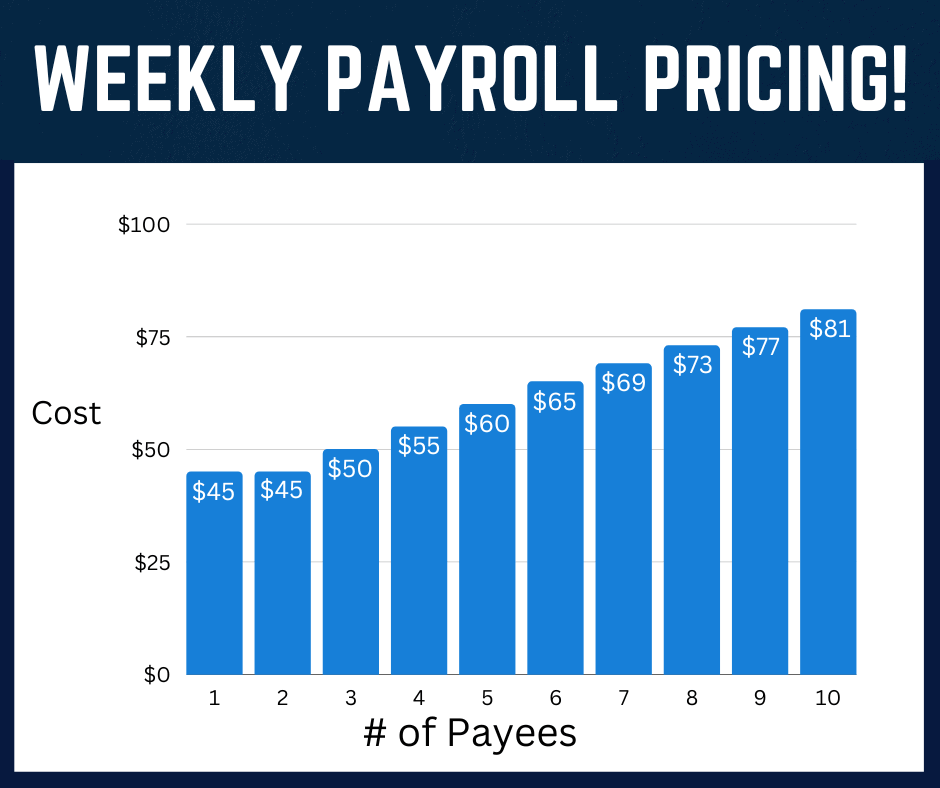

We believe that people like simplicity, especially when it comes to pricing. Our base fee starts at $45 a week for up to two payees. It doesn’t matter if they are 1099, W2, or a combination. Additional payees are an extra $5 per week. Larger companies with more people on payroll will pay less for additional payees.

You can cancel our services at any time. But we will need a phone call or email from the owner, or our main contact with your company stating the date of your last payroll with us. We do not have a cancellation fee.

One of our representatives will contact you to set up a phone call. Why do we need to talk? Because we want to ensure you get the help you need, even if it’s not us.

No, it’s not too bad. We do need your help but try to do most of the work for you. For a 10 – 15 person payroll, we only need about 2 weeks to get you up and running.

Federal Employer Identification Number

Bank information

Basic company information

- Basic payee information

Contact Us!

Have questions about our payroll services? We’re here to help! At Superior Trucking Payroll Service, we prioritize honesty and clarity, striving to provide clear and concise answers to all your inquiries. Whether you’re curious about pricing, service details, or the transition process, our team is ready to assist you every step of the way. Don’t hesitate to reach out – we’re committed to simplifying your payroll experience and ensuring you have the information you need to make informed decisions. Contact us today to get started!