If you’ve ever bounced over a deep pothole in early...

Read MoreBefore learning what an S-corp is, I will give you a short description of what a general corporation is and how it works. A corporation is when a business forms and you submit incorporation files to your state. Corporations are different from other ways of starting a company such as sole proprietorships, partnerships, or LLCs. Corporations include shareholders that own stock in the company and also officers or directors that run the company. As a corporation, you are also required to keep company records and hold regular meetings.

What is an S-corp?

An S-corp or S corporation is also known as an S subchapter. An S-corp is a tax election that lets the IRS know your business should be taxed as a partnership and prevents double taxation.

An S corporation is designed for smaller businesses with 1-100 shareholders as an alternative to the limited liability company (LLC). Being an S-corp, your business owners/shareholders must be individuals, specific trusts and estates, or certain tax-exempt organizations. As an owner, you are considered an employee of the business and must pay yourself a reasonable salary. Both an S-corp and LLC are defined to have a pass-through tax structure. This pass-through tax structure is when the business structure is permitted under the tax code to pass its taxable income, credits, deductions, and losses directly to its shareholders. Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates. This means that you do not need to pay any corporate taxes but instead pay your shareholders, who are responsible for the taxes due. Also, S-corps and LLCs both offer limited liability protection. That is an advantage that an S-corp has over a C-corp.

Advantages of S-corps:

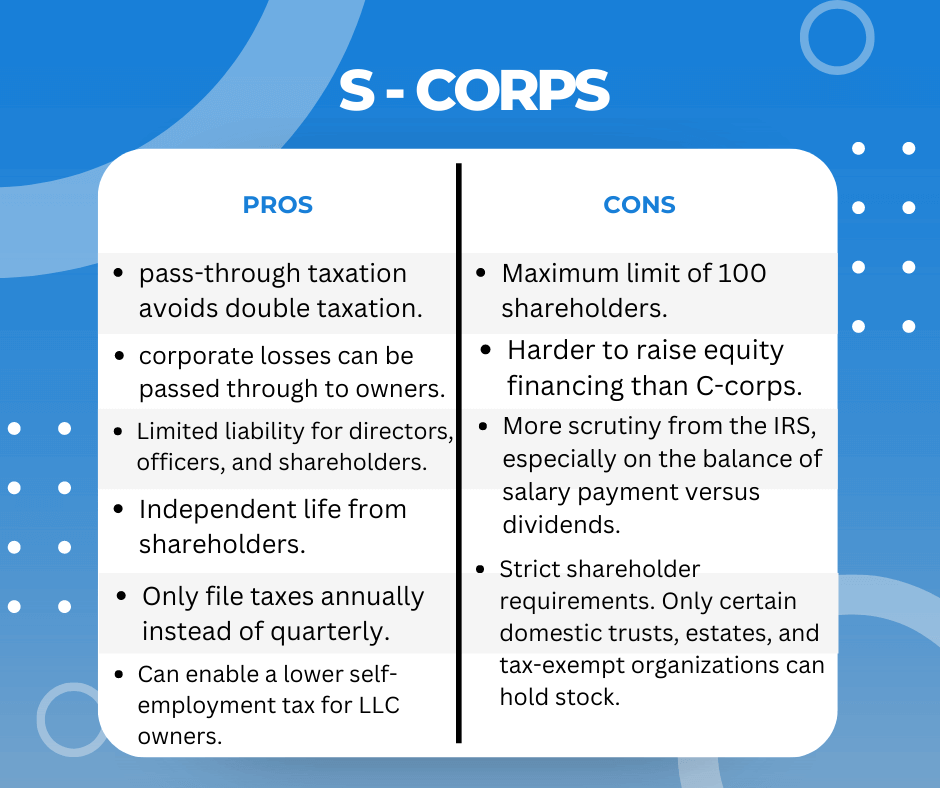

The biggest advantage is not having to pay federal taxes at the entity level. Also, S-Corp status can lower the personal income tax for the owners. S-corp shareholders can be company employees who earn salaries and receive corporate dividends that are tax-free if the distribution does not exceed their stock basis. There are also tax benefits for pass-through entities that apply to S-corp owners. Other advantages include being able to transfer interests or adjunct property basis without facing adverse tax consequences or having to comply with complex accounting rules. S corporation status may help establish credibility with potential customers, employees, suppliers, and investors by showing the owner’s formal commitment to the company.

Disadvantages of S-corps:

Some of the disadvantages of S-corps circle around shareholders. You can only have 100 shareholders. This means that if you want to go public with your business it is not a good idea to become an S-corp. It is also harder to raise equity financing than C-corps. S-corps need to pay their shareholders/employees a reasonable salary before other distributions are made. Since S corporations can make salaries seem like a corporate distribution to avoid paying payroll taxes, the IRS inspect the way S-corps pay their employees. Another disadvantage is when distributions are made, profits and losses are based on a percentage of the ownership or number of shares that each individual holds. Also, an S-corp could be terminated by the IRS if the S-corp doesn’t properly distribute profits and losses, or makes other noncompliance moves in an election, stock ownership, filing requirements, etc. The setup process of an S-Corp requires time and money. There are some fees in some states. Also, the limit on the number of shareholders might be inconvenient for businesses that are quickly growing and want to attract capital and investors.

How to set up an S-Corp?

If you want to set up an S-corp you need to first make sure you fit all of the requirements of an S-corp. To qualify for S corporation status, the corporation must meet the following requirements:

Be a domestic corporation

Have only allowable shareholders

May be individuals, certain trusts, and estates and

May not be partnerships, corporations or non-resident alien shareholders

Have no more than 100 shareholders

Have only one class of stock

Not be an ineligible corporation (i.e. certain financial institutions, insurance companies, and domestic international sales corporations)

If you meet all of the requirements, you will then need to make your business an LLC or a C-Corp and register it with your secretary of state. Then get your Employer Identification Number (EIN) and fill out Form 2553 (The Election by a Small Business form). This document should be signed by all shareholders. See the Instructions for Form 2553 for all required information and to determine where to file the form.

Is an S-Corp right for me?

If you’re wondering if an S-corp would be the best for your company, I would consider the advantages and disadvantages and also look to see if your company meets all the requirements. S-corps, are definitely recommended for small businesses only due to the fact you can only have 100 shareholders. So if you are a fast-growing business the restricted amount of shareholders that you can have might be a strain on your company. But S-corps can be easily changed into C-corps to let the business expand. S-corporations also have the tax advantages of partnerships while also having the benefits of limited liability protection of corporations.

There are protocols, fees, and formalities associated with an S corporation. They are more expensive to maintain along with being more time-consuming than LLCs. You should consider if your company will grow quickly, how much you would pay in taxes, and how much it would cost to do payroll as an S corp. It would be the best decision to reach out to an accountant to have them check out your situation and crunch the numbers before you make up your mind.

Tessa joined Superior Trucking Payroll Service in September 2022. She loves to write and make videos which made her a great asset to the team in her marketing position.

Before working at Superior Trucking Payroll Service she worked in IT at GVSU which gave her the skills to problem-solve with customers over the phone.

Contact Us!

Is Superior Trucking Payroll Service Worth the Higher Cost?

You’re Not Just Buying Payroll — You’re Buying Peace of...

Read MorePayroll for Trucking Companies: We Help Your Whole Trucking Family Get Paid

If you’ve heard of Superior Trucking Payroll Service, you’ve probably...

Read MoreHow Do I Pay Myself If My LLC Is an S-Corp or C-Corp?

How do I pay myself if my LLC is taxed...

Read MoreMarch 2025 Driver Pay Update for Trucking Companies

Are your drivers leaving for better pay? Are you wondering...

Read More