Would You Notice If Your Payroll Was Paying Someone Who...

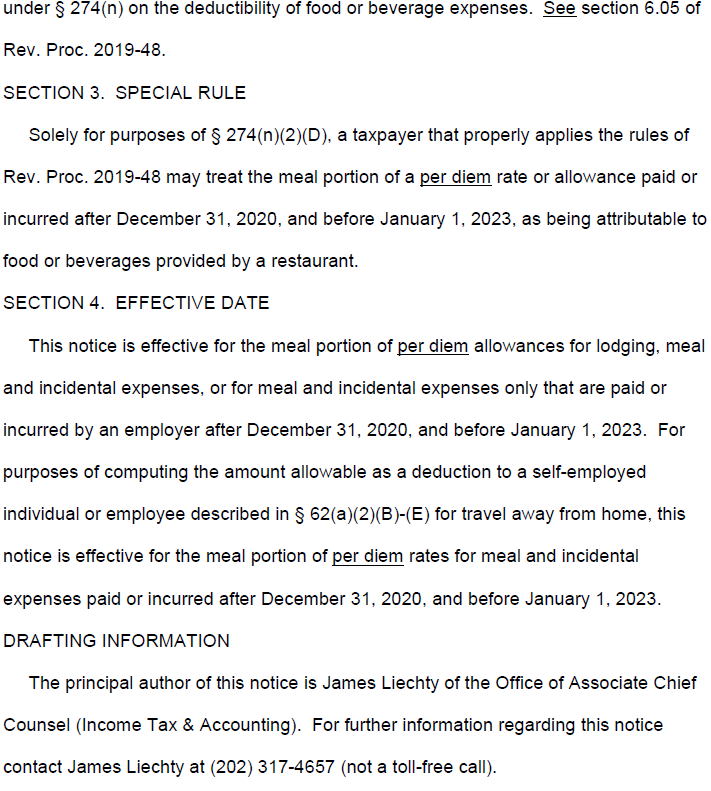

Read MoreBig news! The IRS announced that per diem will be 100% deductible for income tax purposes.

For example, a driver out 260 days (52 weeks 5 days a week) at the current rate of $69.00 per day and the old rate of $66.00 (January 2021 – September 2021) would have made $3,474 in per diem.

In previous years the trucking company would not have been able to deduct the full $3,474.00 of per diem it paid to the driver. Now that money is fully tax deductible.

This will help trucking companies and owner-operators alike. For an owner-operator, they may save on both income and self-employment tax depending on how they are set up.

The notice applies to both 2021 and 2022 tax returns.

Read more about per diem here →

Written by Mike Ritzema

With over 20 years of experience in entrepreneurship, management, business planning, financial analysis, software engineering, operations, and decision analysis, Mike has the breadth and depth of experience needed to quickly understand entrepreneurs’ businesses and craft the most suitable solutions.

Contact Us!

7 Smart Money Moves to Keep Your Trucking Company Profitable

Are you constantly waiting on payments while your bills pile...

Read MoreSecure Online Access to Your Pay Stubs and Tax Documents

As a truck driver, you know that every dollar counts....

Read MoreThe Trucking Payroll People Have a New Partner – Trucking Compliance Just Got Easier!

Helping Trucking Companies Find the Best Compliance Solutions DOT compliance...

Read MoreTrucking Wages Rise: February 2025 Driver Pay Index

Why does truck driver pay drop in January? Will the...

Read More