Early Direct Deposit Explained

We get questions all the time about the new (it’s been around for a little while but still relatively new) early direct deposit. Questions from our clients’ employees asking why they haven’t been paid yet, on Wednesday or Thursday when payday is Friday. Questions from our clients when their employee calls them with the same question. One client even called us mad thinking we had been paying their employees on the wrong day. So let’s talk about it!

- What is early direct deposit?

- What banks participate?

- Is it a good thing?

What is early direct deposit?

We all know that direct deposit is the fastest way to get your paycheck. To understand early direct deposit we first have to understand direct deposit. Here is a quick rundown for anyone not in the know.

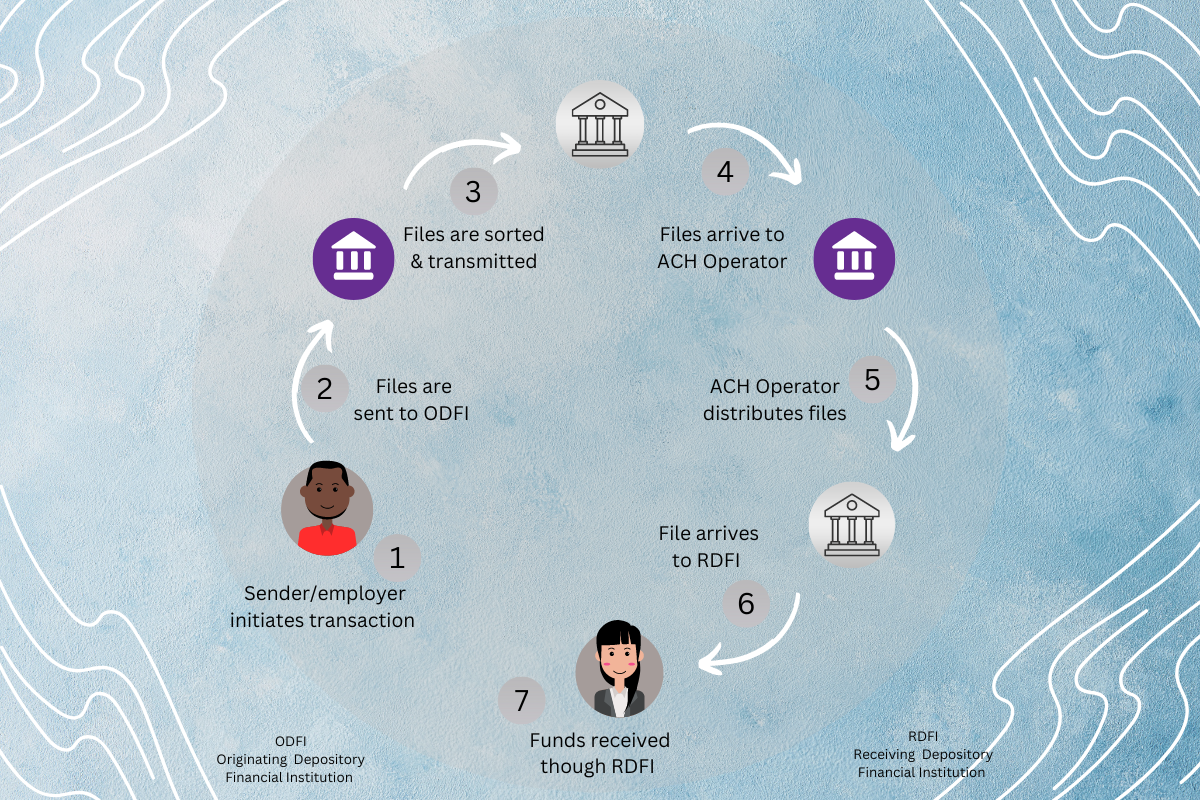

Direct deposit is the electronic version of a paper check. Yes, those were and still are a thing. It works by using ACH (automated clearing house network) to send the funds from company to employee. A typical path for payroll funds can look something like the chart here. It can take up to two days for the money to arrive in the employee’s account, especially with having more than one stop to make along the way.

Some banks are now offering early direct deposits to get you your money even faster. This feature is available with some banks and pay cards. It works similarly to regular direct deposit, except that the bank will deposit the funds into the employee’s account before it has fully processed the payment. In these cases, the banks are sort of acting on faith that the funds will clear.

What banks or pay cards participate?

The list I found of banks that are offering early direct deposits are as follows:

- Albert Cash

- Ally Interest Checking Account

- Ando Spending

- Andrews Federal Credit Union Online Checking Account

- Axos Bank Essential Checking

- Capital One 360 Checking

- Cheese Account

- Chime Checking Account

- Credit Karma Money Spend

- Current Account

- Dave Spending Account

- Dora Financial Everyday Checking Account

- Fifth Third Bank

Is this a good thing?

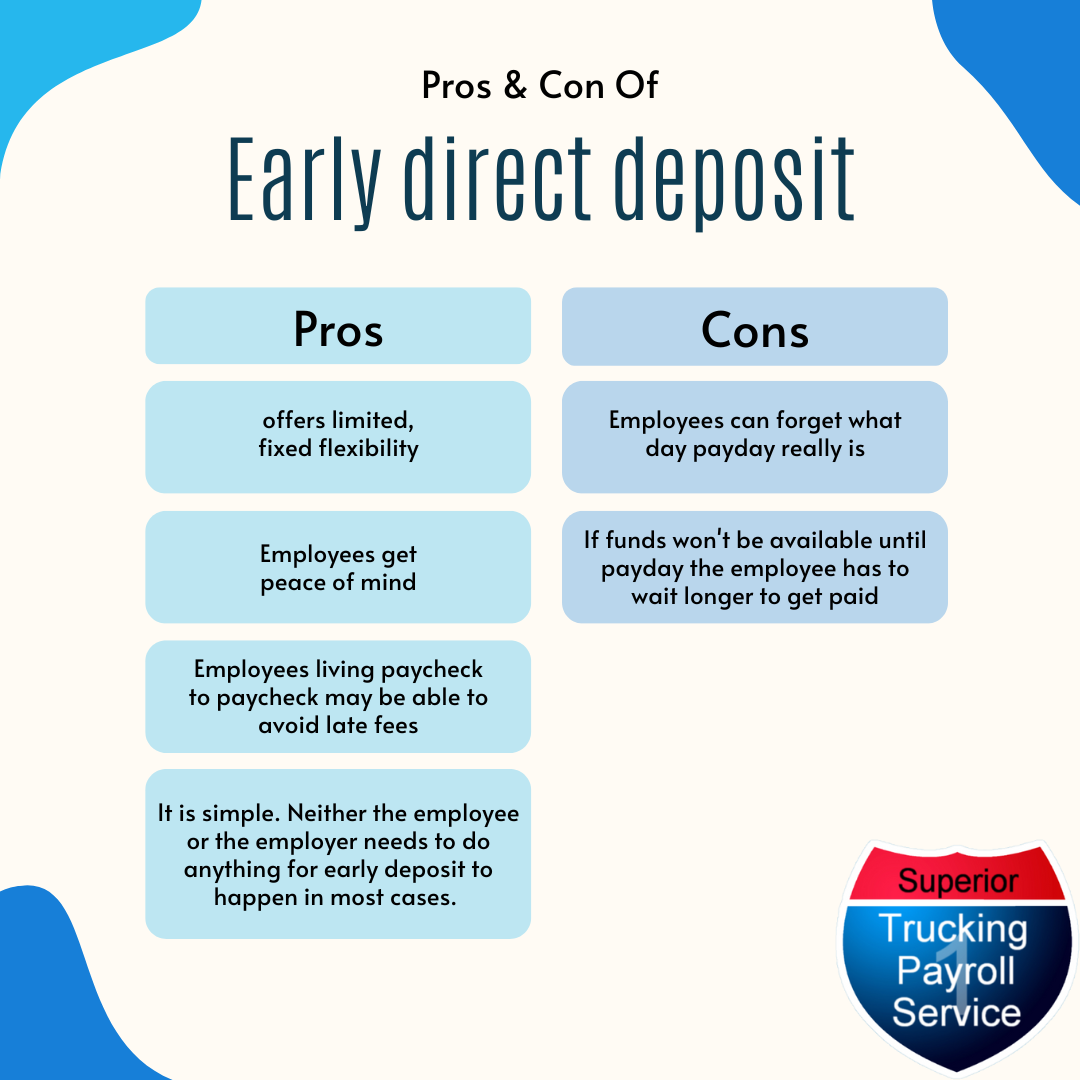

Here is my two cents, take em or leave em. It can be very helpful for someone living paycheck to paycheck to get their funds early. If they always get their funds early are they really early anymore? I’ve taken a page out of Rory Gilmore’s playbook and made a pro-con list for you.

Quick Anecdote:

My last employer was a grocery store chain. During this story, I was working as an Assistant Store Director. In the 4 ish years I had worked there we had always gotten paid Thursday at midnight. Payday was however on Friday.

Well, one Thursday morning I went into work and found an email that said that funds would be delayed and everyone would be paid on Friday, Payday. So I tried to start to go about my day and get the store ready. Not five minutes into the day I had several employees asking what happened. When will they get paid? Can the store advance them? Could I advance them with my own personal money? It was a mess. At one point I honestly was concerned that one person was going to try to break into the cash office. I spent that whole day explaining that payday is on Friday and that for whatever reason we just weren’t being paid early this one time.

At the end of the day, it doesn’t matter much how you feel about it. Employers & employees have no way of opting in or out. It is all up to the bank that the employee is using.

I would make sure you let your employees know what day payday is and even remind them from time to time. This way neither of you ends up in the same situations I’ve mentioned above.

Here are a few other direct deposit tips for you

Written by Harley Houlden

Harley joined Superior Trucking Payroll Service (STPS) in early 2019. With nine years of customer service experience, she truly understands what it takes to make our clients happy. She loves working at STPS because of the family-like atmosphere. Harley’s favorite place to be is Traverse City, Michigan or anywhere that has hippos.