Would You Notice If Your Payroll Was Paying Someone Who...

Read MoreFor truckers in the United States, navigating the intricacies of federal taxes can be a challenging task. Among the various tax-related terms and procedures, “exempt from federal taxes” is a phrase that might pique the interest of many truckers. In this article, we will explore the concept of federal tax withholding, what it means to be exempt from it, the implications of filing exempt on a W-4 form, the legality of claiming exempt status, eligibility requirements, and how truckers in the industry can claim this status while staying compliant.

What is a Federal Tax Withholding?

Federal tax withholding is the process through which employers deduct a portion of their employees’ wages to cover their income tax liabilities. This amount is then sent directly to the Internal Revenue Service (IRS) on behalf of the employees. It ensures that taxpayers fulfill their tax obligations throughout the year, rather than facing a significant tax bill during the tax-filing season.

What Does it Mean to Be Exempt from Federal Tax Withholding?

Being exempt from federal tax withholding means that an individual is not required to have any income tax withheld from their paychecks. Truckers who qualify for this status can keep their entire earnings without any immediate deductions for federal taxes.

What Are the Eligibility Requirements for Claiming Exempt on Taxes?

Truckers in the industry may have the option to claim exempt status on their W-4 form, but this privilege comes with certain conditions. To be eligible, they must meet two crucial requirements outlined by the IRS. Let’s delve into these conditions to understand how truckers can potentially benefit from this status.

Truckers Can Claim Exempt Status on Their W-4 If They Meet Two Conditions:

a. They had no tax liability in the previous year: Truckers must have had no tax liability in the previous year, meaning their total tax owed was zero.

b. They expect no tax liability in the current year: Truckers must reasonably expect to have no tax liability in the current tax year.

What Happens If You File Exempt on Taxes When You Are Not Eligible?

If a trucker falsely claims exempt status on their W-4 and does not meet the eligibility requirements, their employer will not withhold federal income taxes from their paychecks. Consequently, the trucker may face a substantial tax bill when filing their tax return. Additionally, the IRS may impose penalties for underpayment of taxes.

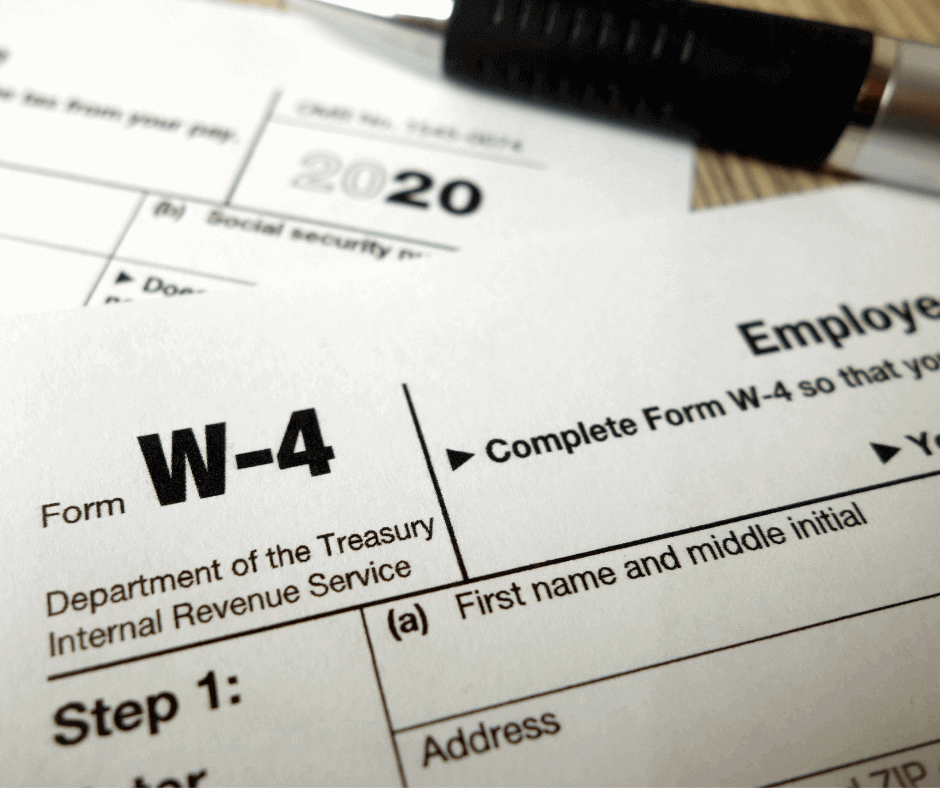

How to Claim Exempt Status on a W-4?

Truckers who meet the eligibility requirements can claim exempt status on their W-4 by accurately filling out the form and indicating their exempt status. However, they must submit a new W-4 form to their employer if their circumstances change, and they no longer qualify for exempt status.

Bottom Line:

For truckers in the industry, understanding federal tax withholding and the option of being exempt from it can significantly impact their financial well-being. While claiming exempt status is legal for those who meet the eligibility requirements, it is essential to adhere to the IRS guidelines accurately. Truckers should stay informed about their tax situation and promptly update their W-4 forms if their circumstances change. Seeking guidance from tax professionals can be valuable in navigating the complexities of tax regulations while ensuring compliance and avoiding potential penalties.

Before founding Superior Trucking Payroll Service, Mike was the CFO of a trucking company with 80 trucks and a thriving brokerage. This experience gave him the perspective that a payroll solution has to make the lives of the office people better. All the solutions he has designed are to benefit everyone. Our company mission is to help trucking families and that includes the company owners, the drivers, and the office.

Contact Us!

7 Smart Money Moves to Keep Your Trucking Company Profitable

Are you constantly waiting on payments while your bills pile...

Read MoreSecure Online Access to Your Pay Stubs and Tax Documents

As a truck driver, you know that every dollar counts....

Read MoreThe Trucking Payroll People Have a New Partner – Trucking Compliance Just Got Easier!

Helping Trucking Companies Find the Best Compliance Solutions DOT compliance...

Read MoreTrucking Wages Rise: February 2025 Driver Pay Index

Why does truck driver pay drop in January? Will the...

Read More