Do you think Per Diem pay only benefits your drivers? You could be missing out on significant tax savings by not offering Per Diem.

At Superior Trucking Payroll Service, we specialize in payroll solutions tailored for the trucking industry and have helped clients save thousands of dollars with well-implemented Per Diem programs. By lowering taxable wages, you can save significantly on payroll taxes and workers’ comp policies.

In this article, you’ll learn how Per Diem can transform your tax strategy and increase your drivers’ take-home pay. By the end, you’ll see why partnering with an industry-focused provider like us can help you get the most out of Per Diem.

Understanding Per Diem for Truck Drivers

Per Diem is a daily, non-taxable allowance that covers extra expenses, like meals, that drivers pay out of pocket while working away from home. The IRS currently allows up to $80.00 per day, with 80% of this being tax-deductible for the trucking company.

How Per Diem Benefits Trucking Companies

Offering Per Diem pay isn’t just a perk for your drivers—it’s a way for your company to save big on taxes and keep costs down.

How Per Diem Lowers Your Tax Bill

When you pay drivers with Per Diem, a portion of their income isn’t taxed like regular pay. This lowers your company’s payroll taxes and reduces your total taxable wage.

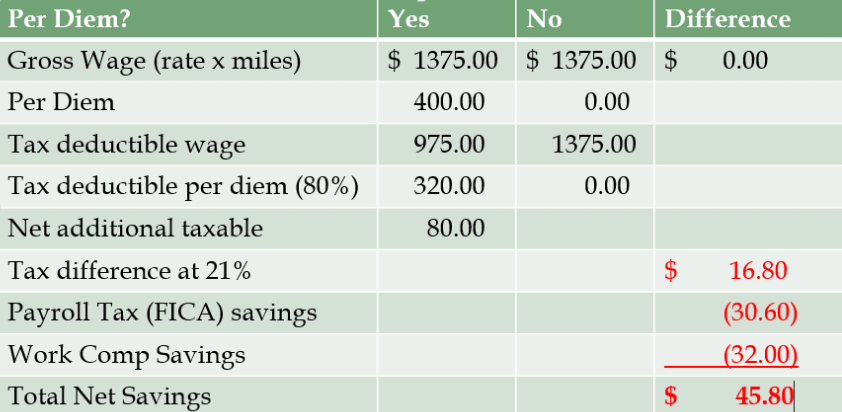

Here’s what that might look like for a trucking company based in Michigan: For one driver earning $1375 in a week, reclassifying $400.00 as Per Diem could save you about $45.80 in payroll taxes on just that driver. Over a year, that’s over $2,300 saved per driver—savings that add up fast if you have a larger team.

Lower Workers' Compensation Costs with Per Diem

Since Per Diem pay isn’t considered part of a driver’s taxable wage, it can also lower your company’s worker’s compensation premiums. Workers’ compensation is calculated based on your gross taxable payroll wages, so reducing taxable wages through Per Diem means a lower premium.

For example, if a driver’s taxable income is reduced by $400 per week through Per Diem, that reduction lowers the total payroll amount used to calculate worker’s comp. Over time, these reduced premiums can make a substantial difference in your overall operating costs, especially if you’re managing a larger fleet.

Maximizing Annual Tax Deductions with Per Diem

Another advantage of offering Per Diem is the year-end tax deduction. The total amount of Per Diem you pay to drivers over the year is 80% deductible on your company’s tax return. This means that every dollar you invest in Per Diem not only supports your drivers but also reduces your taxable income, giving your company significant savings when tax season rolls around.

These tax and workers’ comp savings can make a big impact on your bottom line. But the advantages of Per Diem don’t stop there—it also brings valuable benefits to your drivers. To see just how much your company could save, try our Per Diem Savings Calculator.

Per Diem Advantages for Drivers

Per Diem isn’t just about helping your business save; it also puts extra money into your drivers pockets, which can go a long way to helping them feel valued and supported.

Boosting Drivers' Take-Home Pay with Per Diem

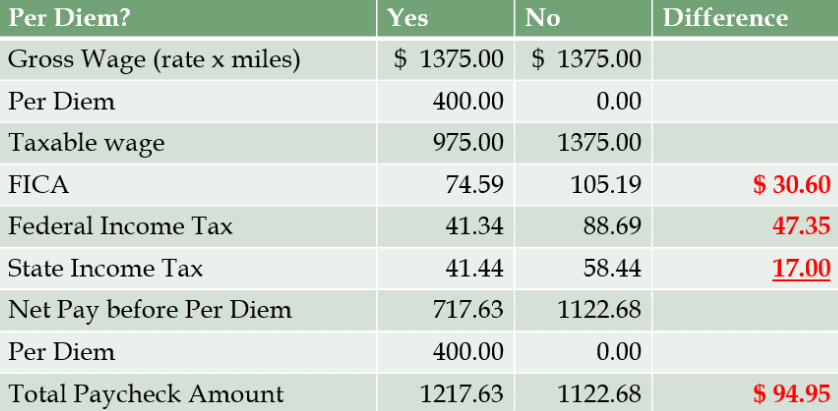

By receiving part of their wage as non-taxable Per Diem, drivers get to take home more of their hard-earned money without increasing their taxable gross pay. This is especially helpful for drivers who are on the road a lot and often need to cover daily expenses out of pocket. What does this mean? They get more money in their pocket!

For instance, a Michigan driver could see an increase of around $94.95 in their take-home pay each week by using Per Diem. Throughout the year, that’s over $4,900 extra in their pocket—an amount that can help cover personal bills or be put away for savings.

Per Diem's Role in Driver Retention and Satisfaction

Increasing take-home pay with Per Diem can help you keep your drivers satisfied, which means they’re more likely to stay with your company. In a competitive industry where drivers can easily jump to other companies, Per Diem can be a meaningful reason for drivers to stick around.

While Per Diem offers great benefits for both drivers and companies, it’s important to consider a few potential downsides to make sure it’s the right fit for everyone.

Potential Drawbacks of Per Diem for Trucking Companies and Drivers

While Per Diem is a valuable tool for saving money, it’s important to consider how it may impact each driver differently. Here are a few key points to keep in mind to ensure Per Diem works well for both your company and your drivers:

Impact on Unemployment and Social Security Benefits

Because Per Diem pay isn’t taxed, this portion of a driver’s income does not count toward Social Security or unemployment benefits. As a result, drivers may receive slightly less from these programs if they eventually need them. For drivers nearing retirement age, keeping taxable wages higher could increase their Social Security benefit when they begin collecting it.

Financial Planning for Drivers Using Per Diem

To prepare for retirement, drivers concerned about benefits can consider directing some of their Per Diem savings into a retirement account. Even a small monthly contribution can grow over time and may provide valuable supplemental income.

Offering Drivers a Per Diem Opt-Out Option

Not all drivers may want Per Diem for these reasons. By giving drivers a choice to opt out, you allow them to decide what’s best for their own financial situation. This flexibility also shows you respect their preferences, which can build trust and loyalty.

Understanding these considerations will help your drivers decide if Per Diem is the right choice for them. Once you’re ready to move forward, it’s essential to know the IRS qualifications for Per Diem to ensure full compliance.

IRS Requirements for Per Diem Eligibility in Trucking

To qualify for Per Diem, drivers need to meet certain IRS rules. For example, they must follow DOT hours of service rules and be working away from home overnight. Drivers with local routes who return home each night do not qualify for Per Diem.

For a full breakdown of these guidelines and how to ensure compliance, see our article, “How to Find Proof that Per Diem is Legal for Truck Drivers,” which covers IRS standards in detail.

Why Per Diem is a Win-Win for Trucking Companies

Offering Per Diem can bring valuable savings to your trucking company while putting more money in your drivers’ pockets. It’s a tax-saving tool that, when used thoughtfully, benefits both your bottom line and your team.

Many trucking companies face the challenge of balancing costs with driver satisfaction, and Per Diem is a smart solution to help achieve that balance. By considering both the benefits and potential downsides, you can make an informed choice that works for everyone involved.

If you’re ready to explore Per Diem further or need help setting it up correctly, we’re here to guide you. At Superior Trucking Payroll Service, we focus exclusively on the trucking industry, so we understand your unique needs.

Ready to discover exactly how much you could save with a Per Diem program? Visit our dedicated page, Per Diem for Trucking Companies, to calculate your potential savings and get started today.

Written by Melisa Bush

With over 15 years of experience in the trucking industry, Melisa is well-versed in the complexities of trucking payroll and adept at navigating special circumstances. Before joining Superior Trucking Payroll Service, Melisa worked at a trucking company, where she managed driver miles and expenses for a fleet of 50 trucks. This hands-on experience gives her unique insight into the challenges our clients face when preparing their payroll data.

Melisa’s top priority is customer service. She strives to treat each client as an individual with genuine needs, rather than just another number in the system. Her goal is to alleviate the burdens of our clients and make their daily operations smoother.