A Guide to the Cost of Payroll with Superior Trucking Payroll Service

If you’re managing a trucking company, you know how crucial it is to get payroll right. Hidden fees and complicated processes from national providers can be frustrating and costly.

At Superior Trucking Payroll Service, we specialize in transparent, all-inclusive payroll solutions tailored to the unique needs of truck drivers. Our goal is to simplify your payroll process, ensuring no surprises and no extra fees.

In this guide, we’ll break down all the costs involved in our payroll services, from weekly fees to one-time setup charges and additional fees, so you can see exactly what to expect.

Our comprehensive service includes:

- Payroll Processing

- Reports

- Customized Pay stubs

- Direct Deposits

- Garnishment Calculations/Payments

- Paystub Website

- Payroll Tax Management

- Year-End Services

Plus, there is no additional charge for adding new hires!

Detailed Breakdown of Payroll Service Fees at Superior Trucking Payroll Service

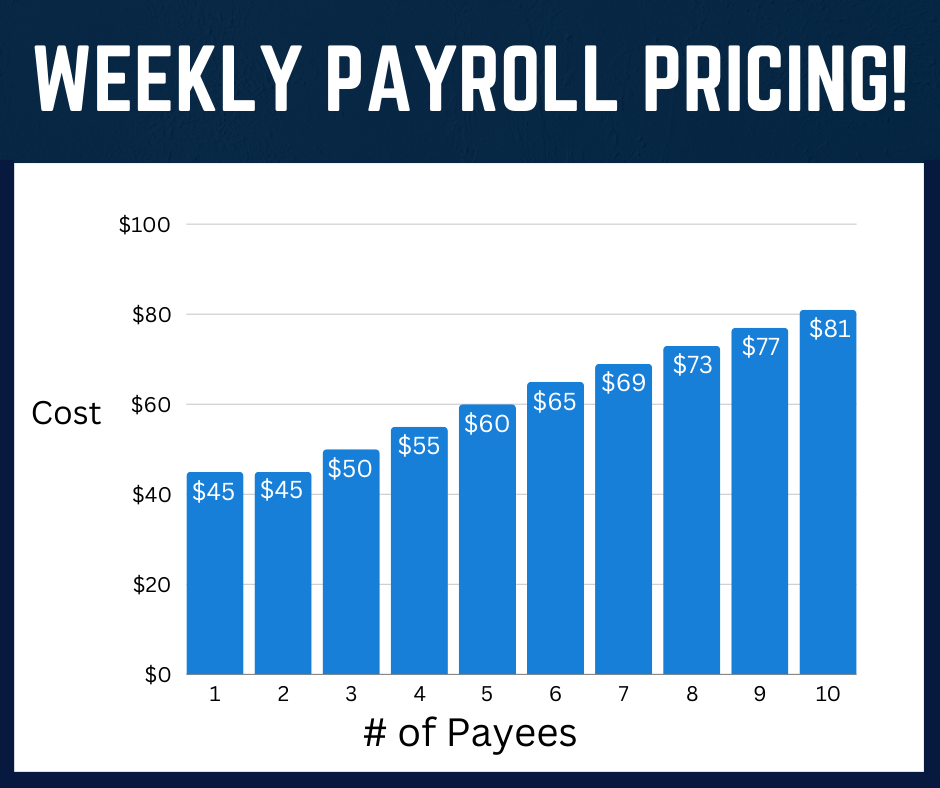

Let’s consider a 2-person weekly payroll, where our service fee stands at only $45 per week. With each additional payee added to your payroll, there’s a mere $5.00 increment in the service fee, for up to 10 individuals.

Once your payroll exceeds 10 payees, the amount per individual decreases. This scalable approach ensures that as your team grows, the cost per employee reduces, making it both flexible and cost-effective.

For those with more than 10 individuals on their payroll, we encourage you to reach out to us directly or to utilize our Price Estimator for tailored pricing. We’re here to accommodate your growing team and ensure our services align with your evolving needs.

Understanding Our One-Time Setup Fee:

We do have a One-Time Set Up fee that covers database setup and registration for payroll taxes, ensuring a seamless transition to our service.

This fee starts at $300 and varies based on the number of people on your payroll and the timing of your first payroll run.

Starting payroll at the beginning of a calendar quarter is the most cost-effective, but we understand that doesn’t always work. First-of-month starts within a quarter and mid-month starts incur higher set-up fees.

Extra Fees You Should Know About?

While we strive to minimize costs, there are occasions when extra fees do apply.

-

Supplemental Payroll Fee: $50 and up

A minimum charge of $50, varying based on the number of individuals included in the extra payroll run.

-

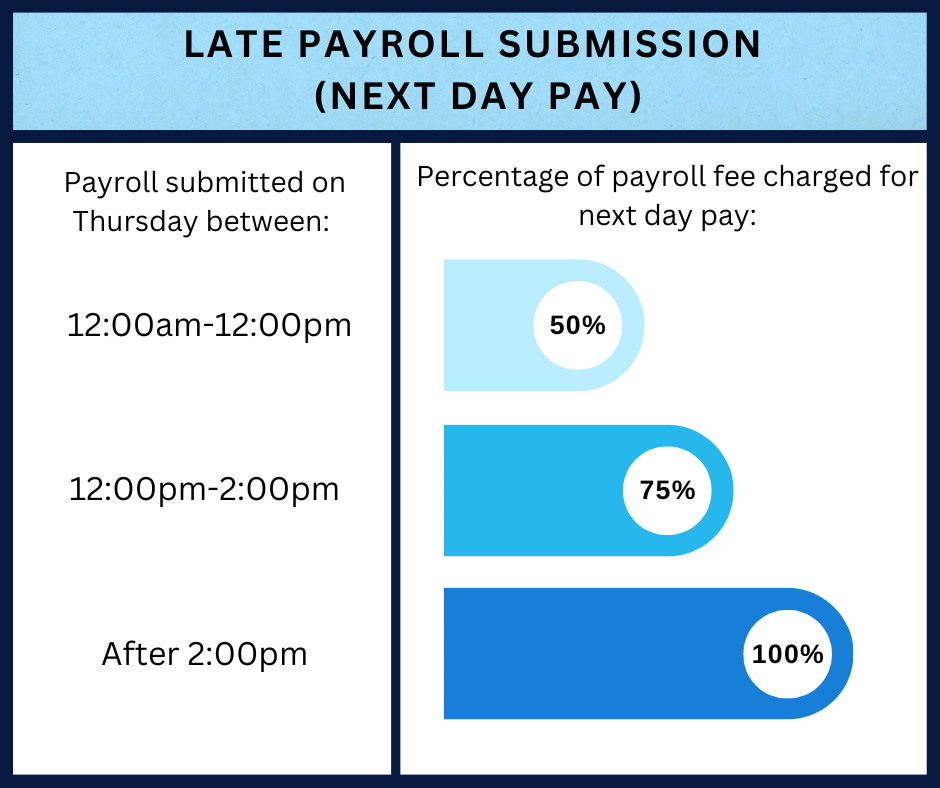

Next Day Pay Fee: $45 and up

Triggered when payroll data is submitted the day before deposits are expected. Rates escalate based on the time of data submission.

-

Same Day Deposits: $10 and up per account

When a client submits data on the day of the expected deposit. Regular service fee plus an extra $10 per account deposited into.

-

Missing Payroll Fee: $15

When payroll cannot be processed for a week or more. $15 charge covers necessary tax filings to maintain compliance.

-

Reversal Fee: $75

$75 fee for reversing an overpayment or incorrect payment.

How to get started?

Simply click on the button below and fill out the short Request a Quote form. Include the number of people you plan to have on your payroll, how often you want to pay, and when you would like to get started. We will be in contact with you soon to go over an implementation plan.

Connect with a Payroll Expert

Clients can also request reports, paystubs, and live checks to be mailed to them. This service requires the cost of postage to be covered, whether via USPS Priority or UPS Service, ensuring timely delivery of essential documents or payments directly to their preferred address.

Comprehensive Payroll Tax Management

Superior Trucking Payroll Service offers comprehensive support for payroll tax management, ensuring clients can focus on growing their businesses without worrying about tax compliance.

Our full-service approach includes:

- Accurate Calculation & Withholding

- Timely Filing of Payroll Tax Returns

- Year-End Tax Forms

- State Unemployment Reporting & Payments

With our expertise and attention to detail, clients can trust us to navigate the complexities of tax laws and regulations, providing peace of mind and ensuring compliance every step of the way.

Partnering with Superior Trucking Payroll means embracing a seamless and transparent payroll solution designed for the trucking industry. Our expertise ensures accurate, efficient payroll processing with no hidden fees. From detailed paystubs to scalable solutions, we support your business growth every step of the way. Ready to revolutionize your payroll process and experience the Superior Trucking Payroll Service difference? Connect with a Payroll Expert today!

Written by Melisa Bush

With over 15 years of experience in the trucking industry, Melisa is well-versed in the complexities of trucking payroll and adept at navigating special circumstances. Before joining Superior Trucking Payroll Service, Melisa worked at a trucking company, where she managed driver miles and expenses for a fleet of 50 trucks. This hands-on experience gives her unique insight into the challenges our clients face when preparing their payroll data.

Melisa’s top priority is customer service. She strives to treat each client as an individual with genuine needs, rather than just another number in the system. Her goal is to alleviate the burdens of our clients and make their daily operations smoother.