Would You Notice If Your Payroll Was Paying Someone Who...

Read MoreCan My Truck Driver Have a Direct Deposit Go Into Someone Else’s Account?

The subject of whether a truck driver can transfer their earnings into another person’s account frequently comes up in the context of payroll and direct deposits.

Even though it would seem like a straightforward request, there could be unexpected problems for your trucking business as a result of the significant consequences. Let’s examine potential risks and determine how to protect the financial integrity of your business.

The Pitfalls of Unauthorized Redirects:

Every now and again, employees ask for a fresh direct deposit form so they can deposit money into someone else’s account—a partner, a significant other, or someone they owe money to. Although you might be tempted to comply with such requests, doing so could have negative effects on your trucking business. This is the reason why:

Irreversible Transactions:

It becomes essential to quickly reverse a direct deposit in the event of an error, such as paying the incorrect person or amount. A direct deposit authorization form that is properly filled out is giving the employer permission to deposit into or reverse a deposit if there was an error. Reversal, or removal, of funds from an account without account holder authorization may result in fines and legal issues.

Risk of Account Holder Complaints:

Account holders are entitled to file complaints in cases when money is stolen without the required authorization. In addition to causing financial losses for the company, this could also result in extra charges or limitations from your bank that would limit your ability to perform transactions in the future.

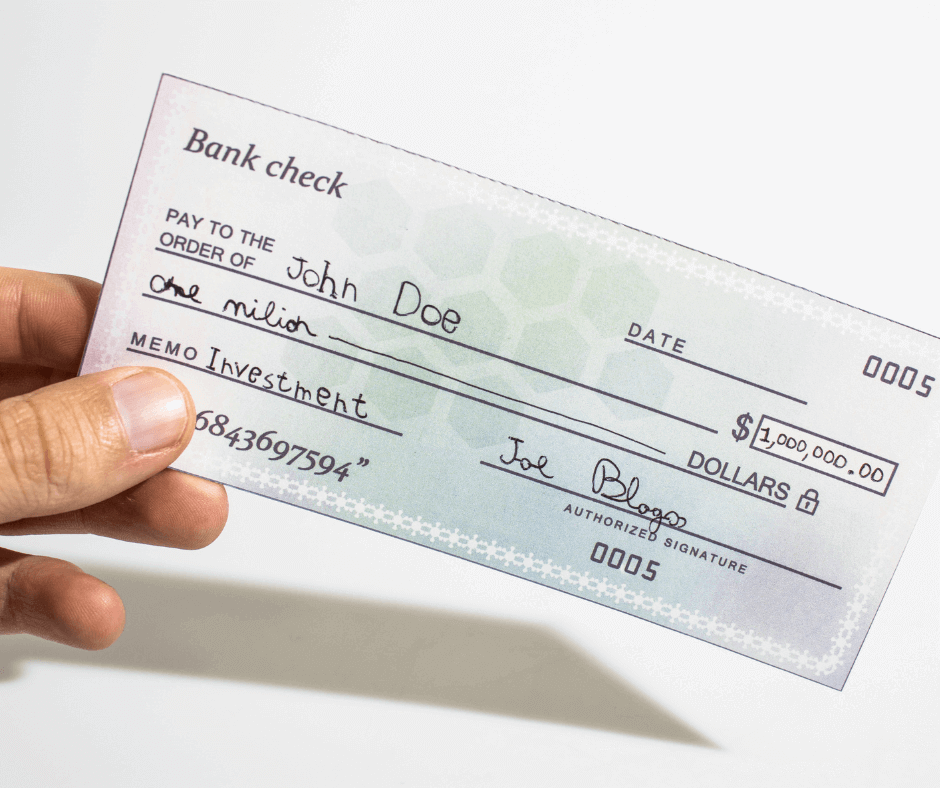

Example:

Sometimes, businesses accidentally pay the wrong person the wrong amount. Say you wanted to pay Joe P. Jones and you paid Joe B. Jones. Joe B. Jones hasn’t worked for the company in years but someone was in a hurry and mistakes do happen. At that point, a reversal of the incorrect direct deposit will need to be made. And if you were diligent and had all forms properly signed, your company’s direct deposit form should allow for a reversal in the case of an error like this.

Here is the catch. If Joe B. Jones, who was paid in error, has an account that he is not listed on, then he can’t authorize the reversal as he has no authority to have funds removed from the account. So now you are taking funds that are not authorized. That’s a no-no. The account holder can get you in trouble for that. If you are fortunate, you will just lose that money. Your bank may impose other fees or could even not let you send money via ACH anymore. It’s just not worth the risk.

Preventing Unauthorized Transactions:

To protect your trucking company from the risks associated with unauthorized direct deposits, implement the following measures:

Documentary Evidence:

Request documentation from employees confirming their association with the designated account. A copy of a check written in their name or a formal authorization letter from the bank or credit union might be used as proof of this. This record acts as a defense against unapproved reversals.

Verification Checks:

To guarantee the accuracy of account information, use extra verification measures. Cross-referencing signatures and account numbers as well as performing routine checks to verify the legitimacy of direct deposit requests may be necessary in order to do this.

Bottom Line:

Although it could be convenient to grant employee requests for several destinations for direct deposit, the risks are much greater than the benefits. Strict procedures, such as verification checks and documented proof, must be put in place to safeguard your trucking company and guarantee the authenticity of each direct deposit. By doing this, you protect your company’s financial integrity in addition to reducing the possibility of illegal transactions.

Tessa joined Superior Trucking Payroll Service in September 2022. She loves to write and make videos which made her a great asset to the team in her marketing position.

Before working at Superior Trucking Payroll Service she worked in IT at GVSU which gave her the skills to problem-solve with customers over the phone.

Contact Us!

7 Smart Money Moves to Keep Your Trucking Company Profitable

Are you constantly waiting on payments while your bills pile...

Read MoreSecure Online Access to Your Pay Stubs and Tax Documents

As a truck driver, you know that every dollar counts....

Read MoreThe Trucking Payroll People Have a New Partner – Trucking Compliance Just Got Easier!

Helping Trucking Companies Find the Best Compliance Solutions DOT compliance...

Read MoreTrucking Wages Rise: February 2025 Driver Pay Index

Why does truck driver pay drop in January? Will the...

Read More