Would You Notice If Your Payroll Was Paying Someone Who...

Read MoreAs a trucking business owner, ensuring your drivers get paid accurately and on time is crucial. Before your payroll provider runs your first payroll, there are three key factors you must address to streamline the process and avoid any hiccups.

1. Data Collection

Your payroll provider will need specific data to run your payroll accurately. This includes your new client paperwork, new hire paperwork, tax information, and other data for tax use. Ensure that you have organized, up-to-date records to provide to your payroll provider. The accuracy of this data is crucial. Compliance with tax regulations is essential to avoid legal issues.

2. Understanding Costs

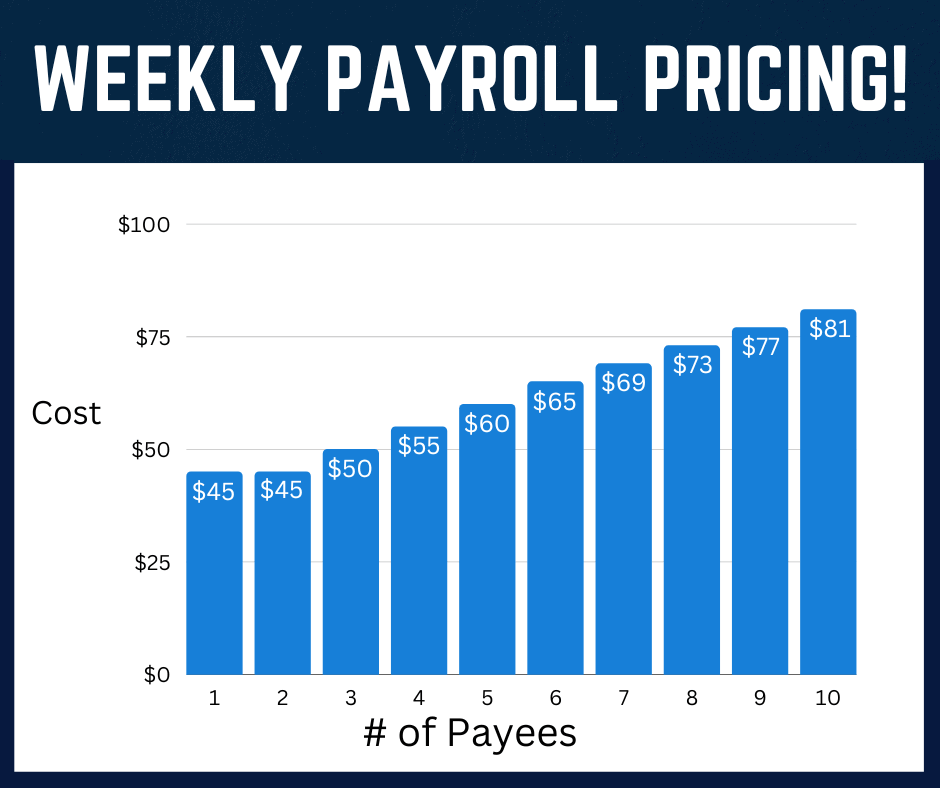

Payroll providers charge fees for their services. These fees can vary based on the provider and the level of service you require. Be sure to understand the cost structure and any potential additional charges such as a start up fee and weekly price. A clear understanding of pricing will prevent surprises down the road. Knowing what you’re paying for allows you to budget effectively.

Moreover, you need to comprehend the scope of services provided. Are they offering essential payroll processing only, or do they include additional services like time tracking, tax filing, and HR support? Clarifying this upfront ensures that you receive the services you need.

3. Reporting and Communication

Your provider will generate various reports, and you should understand what these reports entail. Regular communication with your provider is also crucial. Be prepared to ask questions and seek clarification whenever needed. A responsive provider will ensure that your payroll runs smoothly.

Bottom Line:

Before your payroll provider processes your first payroll, ensure that you’ve provided the necessary tax documents and new hire forms. Make sure your employees’ data is accurate and up-to-date, and they have filled out their W-4 forms. Additionally, have a clear understanding of the costs and services your provider offers. With these three key aspects in place, your trucking business can look forward to smooth and hassle-free payroll processing, helping to keep your drivers satisfied and your finances in order.

Written by Harley Houlden

Harley joined Superior Trucking Payroll Service in early 2019. Her main roles are Inbound sales, Implementation, and marketing. She loves the work atmosphere.

“It feels like everyone here is a family. Even when we add someone new to the team, they just meld right in.”

Before joining STPS she worked at a local chain grocery store starting in 2013 as a cashier and by the time she left in 2019 was an assistant store director.

Contact Us!

7 Smart Money Moves to Keep Your Trucking Company Profitable

Are you constantly waiting on payments while your bills pile...

Read MoreSecure Online Access to Your Pay Stubs and Tax Documents

As a truck driver, you know that every dollar counts....

Read MoreThe Trucking Payroll People Have a New Partner – Trucking Compliance Just Got Easier!

Helping Trucking Companies Find the Best Compliance Solutions DOT compliance...

Read MoreTrucking Wages Rise: February 2025 Driver Pay Index

Why does truck driver pay drop in January? Will the...

Read More