Would You Notice If Your Payroll Was Paying Someone Who...

Read MorePayroll processing is an essential component of managing a business. Employers can process employee payroll, tax compliance, direct deposit, and other business-related chores in-house or by using a payroll service.

All business must have accurate payroll. Incomplete or unfiled tax returns can result in penalties and increased costs.

Determining the cost of payroll services for your trucking company involves several factors.

Let’s explore the various components that influence pricing:

Pay Frequency: Pay frequency, such as weekly or semiweekly, affects the cost of payroll services.

Number of Employees: The total number of employees in your trucking company impacts the pricing structure.

Direct Deposit Accounts: If you require direct deposit accounts for your employees, the quantity of such accounts may affect the overall cost.

Third-Party Checks: Consider the number of third-party checks you may need for obligations like child support, tax levies, or garnishments.

Year-End W-2 Forms: The number of W-2 forms you anticipate printing at year-end should be taken into account during the pricing evaluation.

Tax Jurisdictions: The number of local and state tax jurisdictions you withhold and remit taxes to can influence the pricing of payroll services.

Additional Reporting Needs: Consider whether you require additional reporting services such as 401k reporting, workers’ compensation reporting, or AFLAC reporting.

Furthermore, certain fees may be associated with tasks that don’t occur with every payroll cycle, such as monthly and quarterly tax payments, filing of tax forms (941, state or local withholding, unemployment), W-2 printing and filing, 940 filings, and more.

Different payroll service providers offer various pricing models. Some companies offer pricing where each service is individually priced, while others bundle all services into a single rate. Bundling services can provide clarity and eliminate surprises at the end of a quarter or year. It’s important to note that the total cost of both pricing models often aligns when considering the annual expenses.

When comparing quotes from different providers, accurately assessing the number of W-2 forms you’ll need at year-end is crucial. The number of W-2 forms may differ from the total number of employees due to factors like turnover, seasonal workers, or changes in employment status. Ensuring accurate quoting based on the anticipated number of W-2 forms will help you make informed decisions.

How much do we charge for our trucking payroll service?

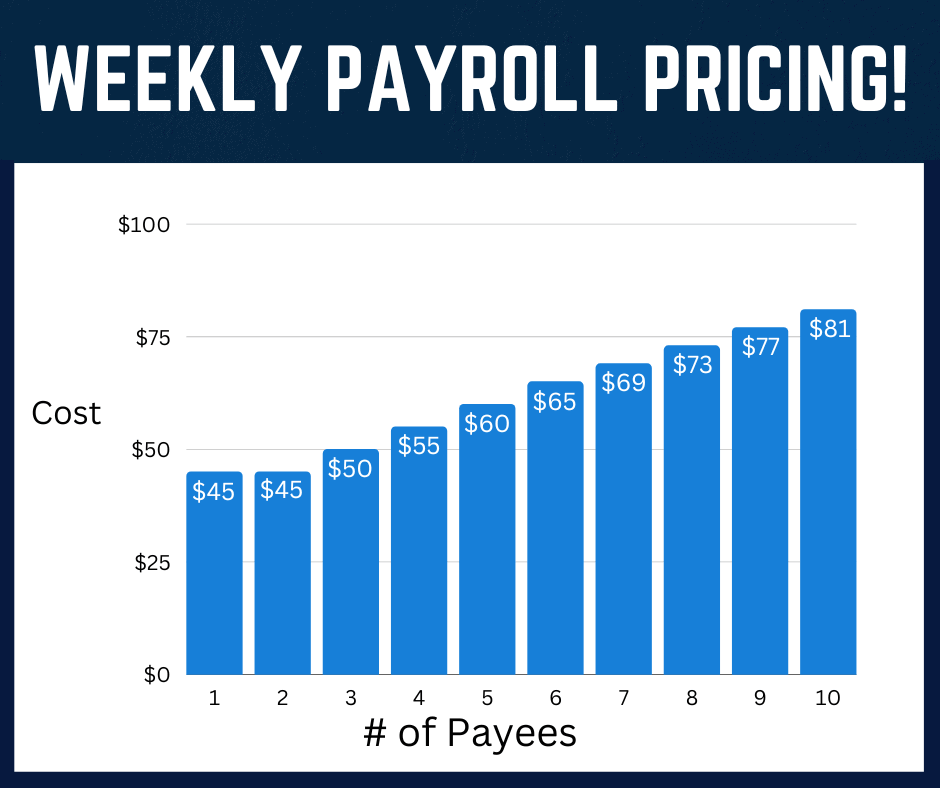

At Superior Trucking Payroll Service, we offer a transparent pricing structure. For weekly payrolls with ten employees or less, refer to the chart on the right for our rates. If you have more than ten employees, we prefer to have a conversation with you to gather additional information. Our pricing per pay decreases as the number of employees increases.

We believe in providing all-in pricing to avoid unexpected surprises later on. Just as your customers wouldn’t appreciate unexpected bills after delivery, we strive for transparency, and do not nickel and dime our clients.

While our pricing may not make us the cheapest option, along with processing your payroll you will have access to our trucking expertise. If you prioritize cost we may not be a good fit for you and we can recommend alternative providers such as Gusto or Intuit QuickBooks payroll.

Feel free to reach out to us for a detailed discussion and personalized recommendations based on your specific needs. Also, here is the link that will being to straight to our Payroll Services page.

Before coming to Superior Trucking Payroll Service, in 2011, Melisa worked for a trucking company with 50 trucks. She was the one who processed the driver’s miles and expenses.

Because of this experience, she understands the challenges our clients go through each week while preparing their payroll data for us. Customer service is #1 for Melisa. Her goal is to treat our clients like people with true and real needs, not just another number.

Contact Us!

7 Smart Money Moves to Keep Your Trucking Company Profitable

Are you constantly waiting on payments while your bills pile...

Read MoreSecure Online Access to Your Pay Stubs and Tax Documents

As a truck driver, you know that every dollar counts....

Read MoreThe Trucking Payroll People Have a New Partner – Trucking Compliance Just Got Easier!

Helping Trucking Companies Find the Best Compliance Solutions DOT compliance...

Read MoreTrucking Wages Rise: February 2025 Driver Pay Index

Why does truck driver pay drop in January? Will the...

Read More