If your business withholds federal income tax from non-payroll payments, you must file IRS Form 945. However, many companies either miss the deadline or fill it out incorrectly, which can lead to costly IRS penalties.

We know tax forms can be confusing and stressful—but they don’t have to be. This guide will break down everything you need to know about Form 945 in plain, simple language.

By the end of this article, you’ll understand how to stay compliant and avoid costly IRS penalties.

*** We suggest talking to our tax preparer or accountant ***

What Is IRS Form 945?

IRS Form 945 is a tax form used by businesses and employers to report federal income tax withheld from non-payroll payments.

What Counts as a Non-Payroll Payment?

Non-payroll payments include:

- Pension and retirement plan distributions (401(k), 403(b), 457(b), and IRAs)

- Annuities

- Gambling winnings

- Military retirement payments

- Payments to independent contractors (if subject to backup withholding)

- Any other payments where federal tax was withheld

Who Needs to File IRS Form 945?

You must file Form 945 if you:

- Withhold federal income tax from non-payroll payments

- Are required to withhold taxes on certain payments (even if you didn't do it)

Important: IRS Form 945 is NOT for payroll taxes

Many business owners confuse form 945 with Forms 941, 943, or 944, which report payroll-related withholdings (such as Social Security, Medicare, and employee wages). However, Form 945 is completely separate and only reports federal income tax withheld from non-payroll payments.

Because Form 945 is not a payroll tax form, it is NOT filed by payroll service providers like Superior Trucking Payroll Service. Instead, this form is typically handled by the business owner or the company’s accountant as part of annual tax filings.

When and How to Pay IRS Form 945 Taxes

Businesses must deposit the taxes reported on Form 945 throughout the year. The IRS assigns businesses one of two payment schedules:

Monthly Depositor Schedule

- If your total Form 945 tax liability for the previous two years was $50,000 or less, you are a monthly depositor.

- Due Date: Deposit tax payments by the 15th of the following month.

Semiweekly Depositor Schedule

- If your Form 945 tax liability was more than $50,000, you must follow the semiweekly schedule.

- Due Date:

- If payment was made on Wednesday, Thursday, or Friday, deposit taxes by the following Wednesday.

- If payment was made on Saturday, Sunday, Monday, or Tuesday, deposit taxes by the following Friday.

Tip: To check your deposit schedule, look back two years (for 2023 payments, check your 2021 Form 945).

Step-by-Step Guide to Filing IRS Form 945

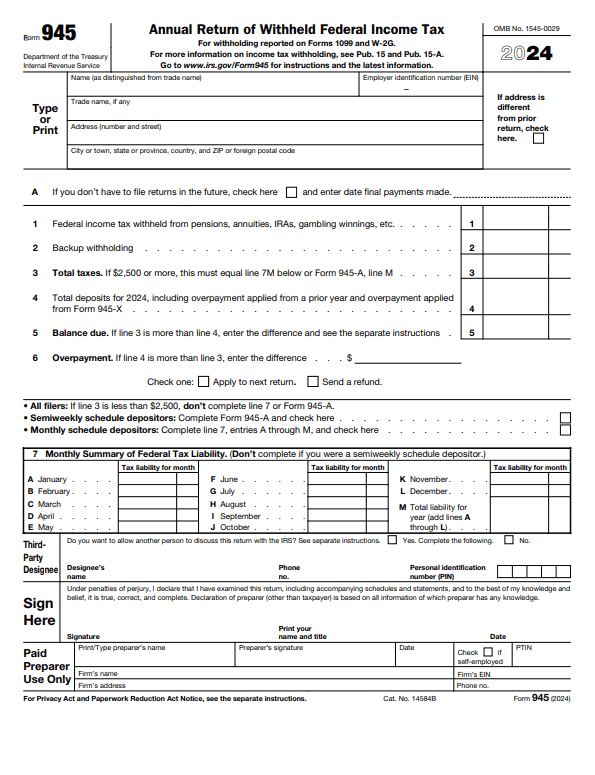

Form 945 is short—just seven lines long. Here’s how to fill it out:

-

Enter Business Information

Fill in your name, address, and Employer Identification Number (EIN)

-

Report Total Withheld Taxes

Write the total amount of federal income tax withheld from all non-payroll payments.

-

Include Additional Taxes (if any)

If you withheld extra amounts, report them separately.

-

Calculate Total Taxes Owed

Add Lines 1 and 2 to find the total tax due.

-

Enter Deposit Amounts

If you overpaid, subtract that amount. If you underpaid, enter the amount owed.

-

Report Monthly Deposits (if required)

Boxes A–L are for monthly deposits; Box M shows the yearly total.

-

Check the Final Return Box (if applicable)

If this is your last Form 945 filing, check the final return box and enter the date of last payment.

Remember: If you work with Superior Trucking Payroll Service, we handle payroll taxes—not Form 945. Since Form 945 covers non-payroll withholdings, it should be filed by your business or your company’s accountant.

When Is IRS Form 945 Due?

- Due Date: January 31st each year.

- Exception: If you pay all taxes on time, you get extra time to file—until February 10th.

How to File Form 945

You can file Form 945 in two ways:

- E-File – Use IRS-approved tax software or a tax professional.

- Mail It – If filing by mail, use the correct IRS address (based on your location). Make sure it's postmarked on or before the deadline to avoid penalties.

What Happens If You File Form 945 Late?

Filing late or incorrectly can result in IRS penalties:

- Failure to File: 5% per month, up to 25% of the unpaid tax.

- Failure to Pay: 0.5% per month, up to 25%.

- Incorrect/Inaccurate Filing: $50 per mistake (up to $550,000 per year).

Avoid penalties: Pay taxes on time and double-check your form for errors!

Bottom Line: Do You Need to File IRS Form 945?

Filing IRS Form 945 correctly is essential to staying compliant and avoiding costly penalties. Missing deadlines or making errors can result in hefty fines, which no business wants to deal with.

We know that tax compliance can feel overwhelming, especially with all the different IRS rules and forms. But you don’t have to figure it out alone.

For trucking businesses, Taxes4Truckers specializes in helping companies like yours navigate tax filings with ease. Their experts make sure everything is done correctly and on time so you can focus on running your business.

Still confused about Form 945? Taxes4Truckers specializes in tax compliance for trucking companies, ensuring you meet deadlines and avoid penalties. Reach out today and let the experts handle it for you!

Written by Mike Ritzema

Before founding Superior Trucking Payroll Service, Mike was the CFO of a trucking company with 80 trucks and a thriving brokerage. This experience gave him the perspective that a payroll solution has to make the lives of the office people better. All the solutions he has designed are to benefit everyone. Our company mission is to help trucking families and that includes the company owners, the drivers, and the office.