If you’ve heard of Superior Trucking Payroll Service, you’ve probably...

Read MoreNot every payroll service is right for every company. Finding all the best options and taking the time to compare them all is a lot of hard work. I know because I did it for you to make this list below. All of these payroll services have been considered to be the best for small businesses. These payroll services have been rated based on pricing, benefits, features, and reviews from customers. Based on this research you will find out which payroll service is right for your small business.

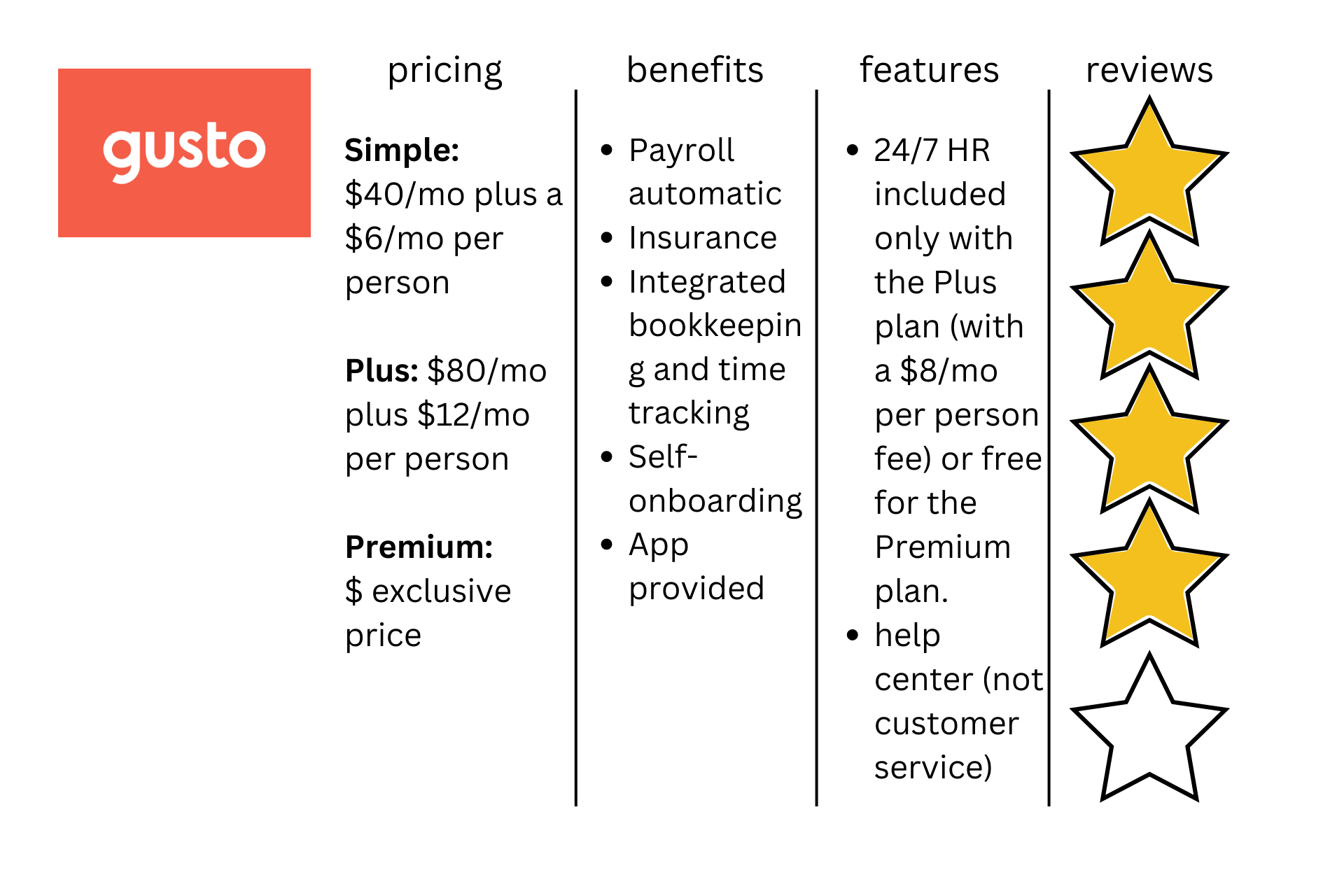

Gusto:

Gusto is an online software for small growing businesses that includes cloud-based, automated payroll, benefits, and human resource administrative services. It gives you the extra time you need to focus on your business by making payroll easy. Gusto payroll is fit for employees and contract workers and includes benefits for them such as health and retirement plans.

Payroll through Gusto is automated through the schedule that you set that is for hourly and salary workers. Employees will also get emailed when they get paid. It keeps records of all pay stubs that are accessible through Gusto’s app along with a time tracking software to let employees and contractors track their hours. It even files the employer and employee’s taxes.

Gusto also offers software called Gusto Wallet which lets your employees get same-day paychecks so they don’t have to wait for the scheduled payday. They also would receive savings accounts and loans in between payrolls.

Gusto would be the right payroll service for you if you had a small growing business. It’s specifically good for if you have a lot of contract workers. Considering that this payroll service is all online you wouldn’t receive a personal service with a great customer service office. So if you’re looking for a payroll service that is more customer service based, Gusto is not right for you.

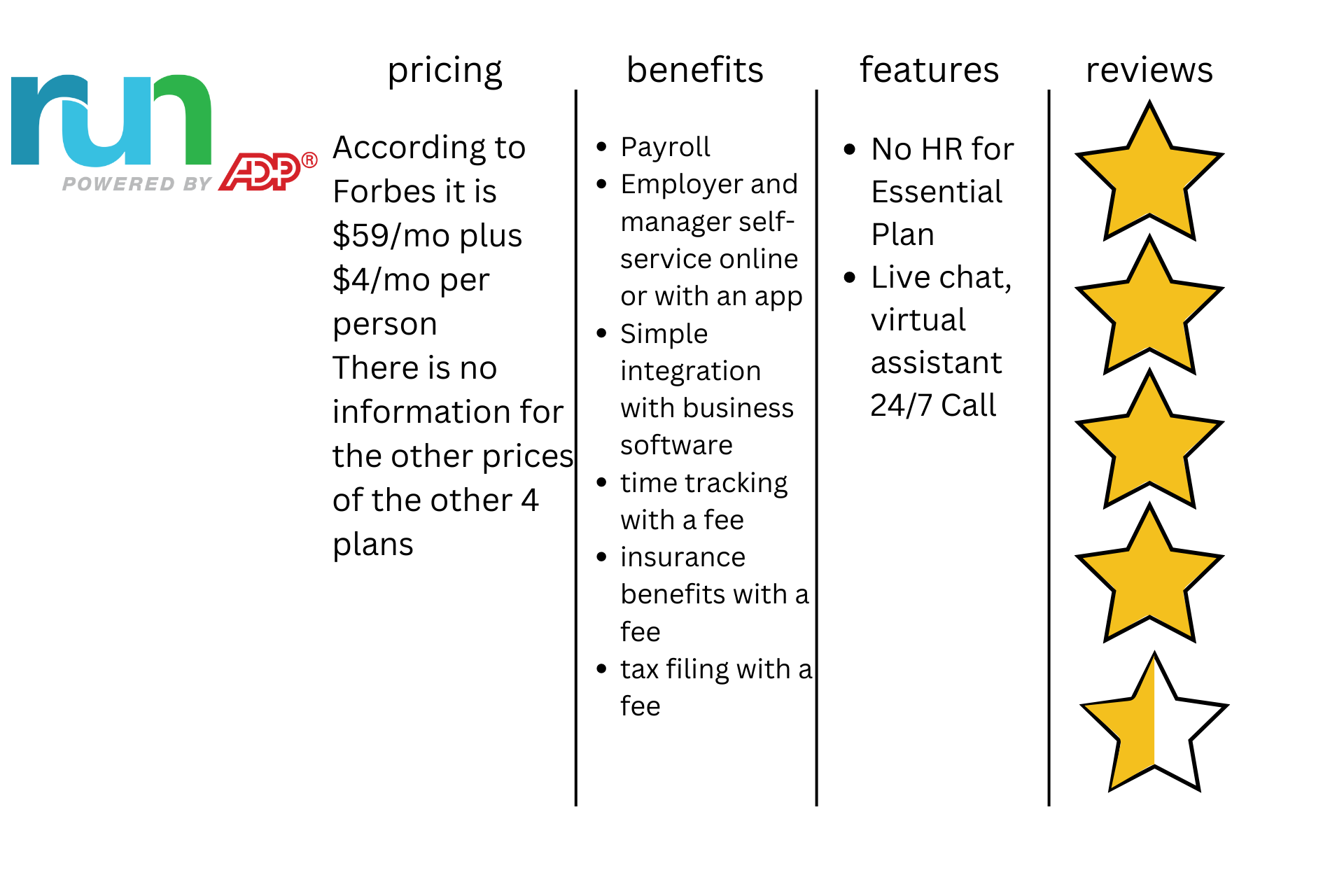

ADP RUN:

ADP is one of the most well-known payroll services out there. It can be used by small, medium, and large companies. ADP RUN, it’s an extension for smaller companies such as start-ups or businesses with 50 employees or fewer. ADP RUN has custom-built plans that are made specifically for your company. This service offers automatic reporting and tax filing, automated payroll, and benefits that are optional in a self-service platform available for employees.

ADP RUN is a basic plan for running payroll through direct deposit or by printed checks delivered to you before payday. You can only pay 1099 contractors if you have at least one employee that has a W2.

The ADP RUN plan does not include benefits, time tracking options, or automated tax filing. They do include the option to make those add-ons to your plan for a fee. I could not find out how much that fee would be. Your employees would be able to have health insurance, workers’ compensation, plans for retirement, be able to clock in and out right from the ADP platform, and ADP would file taxes.

Their integration process is very simple for automatically syncing your payroll and bookkeeping from different software. ADP RUN also includes an optional debit card that gets loaded through direct deposit. The employees can access their paychecks and get paid 2 days in advance, along with putting money on that card from different places so it’s close to a digital checking account.

ADP RUN would be the right payroll service for you if you are a small company with less than 50 employees. Also, if you want a more one-on-one customer service experience and are also a company expected to grow so it would be very simple to switch over to ADP enterprise platforms.

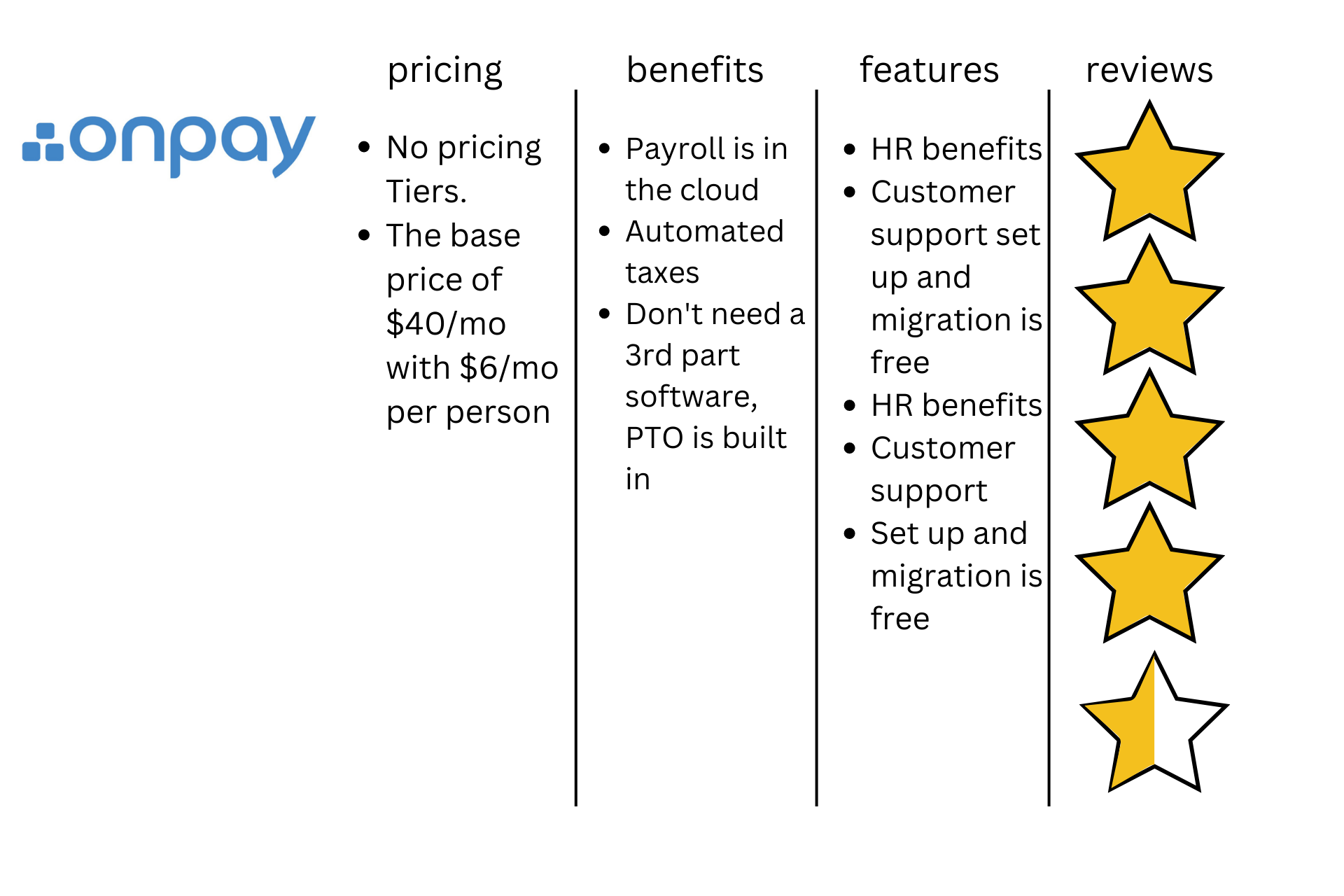

OnPay:

Since there is only one plan that is available for OnPay, it is very simple and affordable with a lot of features. The best features include an employee portal where they can onboard themselves, and unlimited payroll runs to pay W-2 and 1099 workers. You have access to new hire reporting, HR resource library, and other HR helpful tools.

OnPay is a cloud-based platform that can be easily navigated to pay your employees and contract workers by using a simple method to run payroll by logging into your account from anywhere. OnPay also supplies insurance, retirement, and workers’ compensation through the HR team.

Payroll can be scheduled in any way you want for both employees and contract workers. Unfortunately, they don’t offer a same-day or next-day payday direct deposit. You can pay through direct deposit, check, or debit card.

Taxes are almost all automated. Everyone can access their self-service employee portal along with their tax exemptions, deductions, and tax files for the end of the year. OnPay will deduct what’s necessary automatically and file your taxes at the end of the year for your company.

HR tools are available as well including PTO tracking and approving and help with new hires to get through onboarding quickly. Employees and employers can access this within the OnPay app. Also, any apps that you are currently using for time tracking or other services can be easily integrated and synced with OnPay.

OnPay is an affordable payroll processing for small businesses with many features. If your company is small but is growing fast, this would be a great pick for you since the flat monthly rate doesn’t change. You only have to pay more as your employee amount goes up.

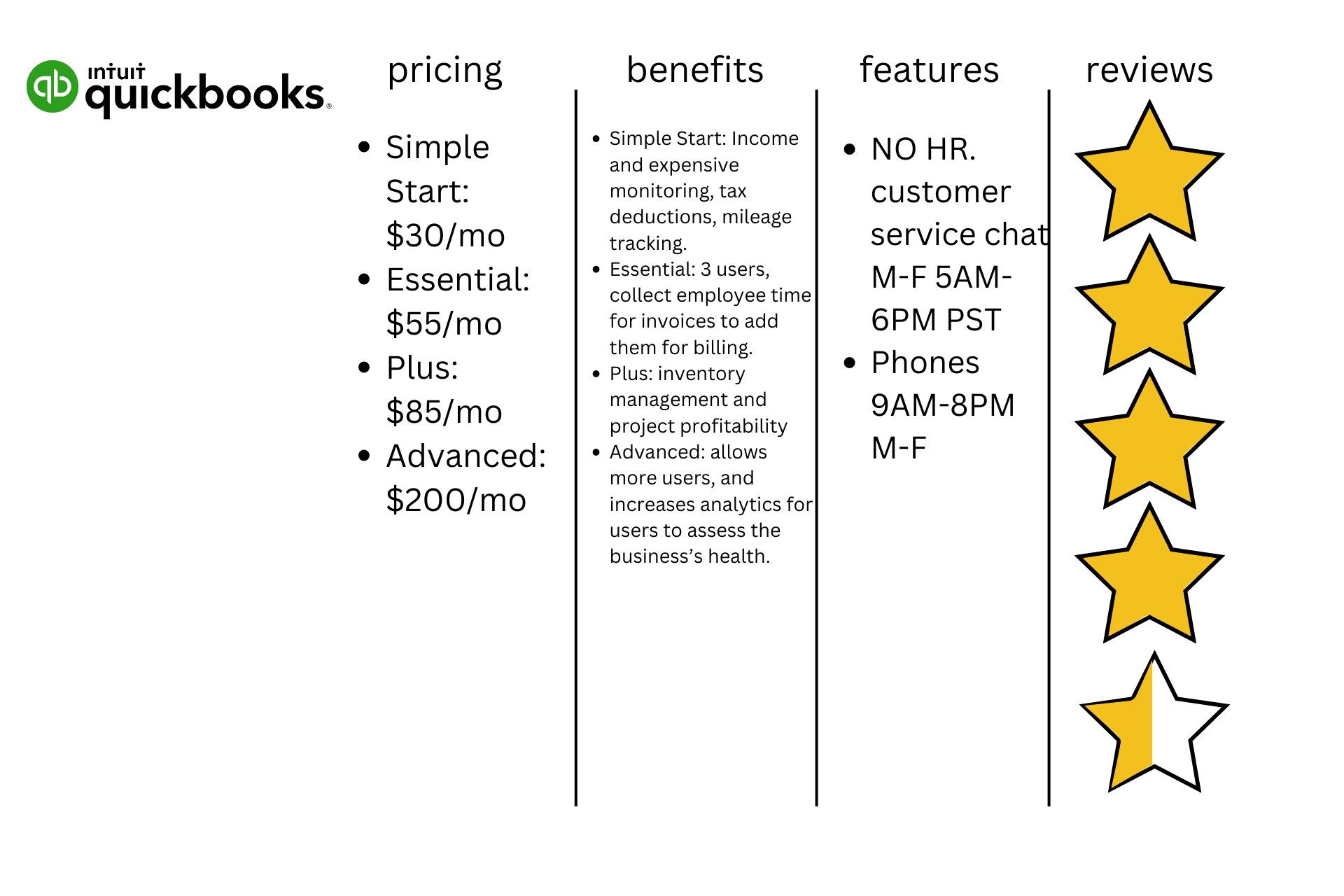

QuickBooks:

QuickBooks is a good software to start out your small business with because it has all that you will need for accounting, bookkeeping, budgeting, invoices, and expense tracking. QuickBooks Simple plan is cloud-based and covers your basic needs of accounting, income and expense monitoring, invoice and payment capability, receipt capture, mileage tracking, and tax deductions.

A payroll feature can be added on for around $22.50 more per month plus $5 per employee. This feature will also include tax filing and next-day direct deposit. Although QuickBooks is one of the most popular software services, customers have mentioned that there are problems with small problems like miscategorizing or duplicates. With minimal live customer service help, many customers have gone to self-help articles or videos to fix their own problems.

QuickBooks could be a good option for you if you are a small business that is just looking to have software that makes invoicing easier. It will also be good for you if you are not always at a computer because they have an app that brings all the features from your account onto the online platform.

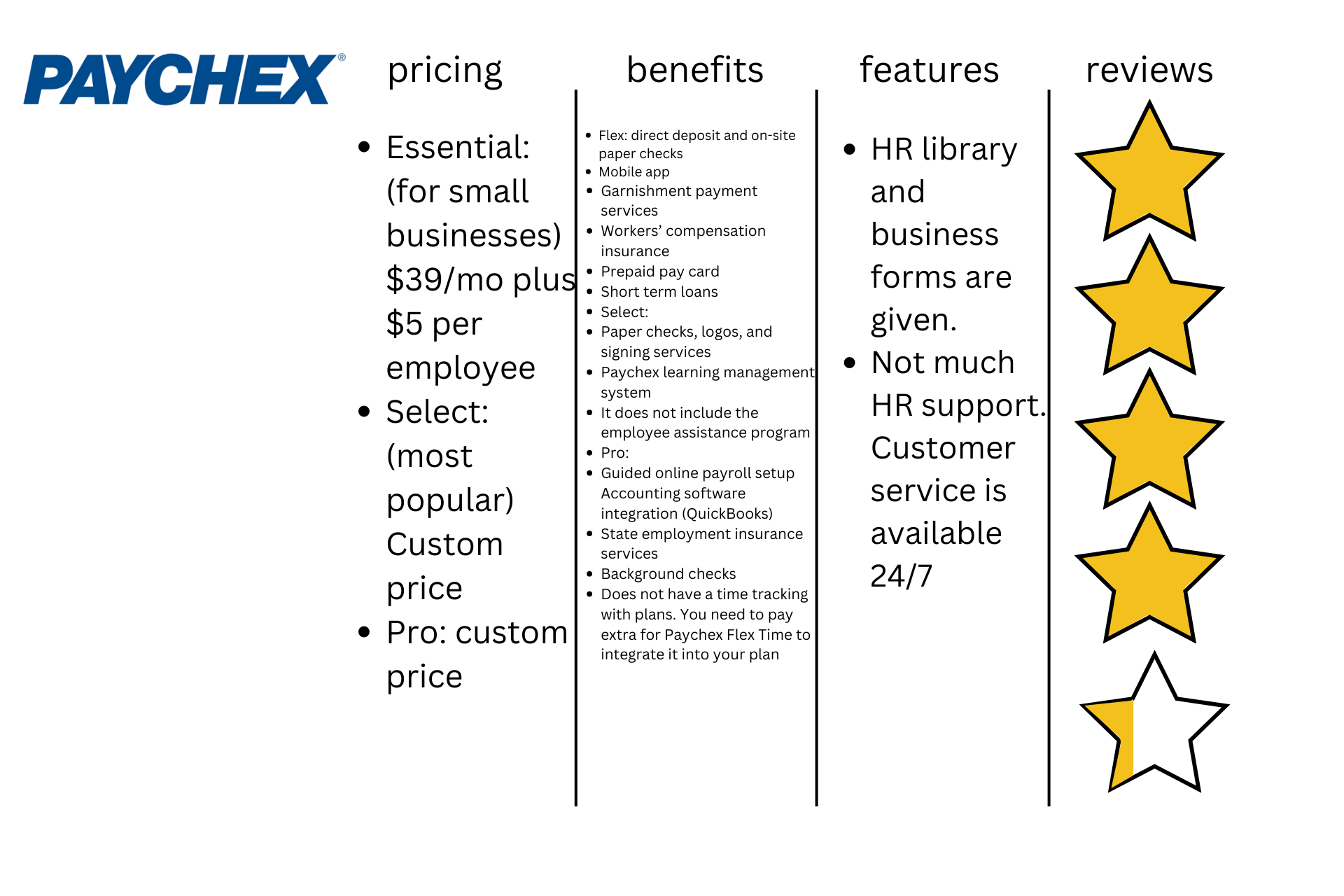

PayChex Flex:

Paychex Flex is one of the best services for small businesses if they are just looking for easy employee payroll. All features other than payroll are done through a suite with add-on costs. There is a self-service portal where employees can look at their tax deductions and pay stubs. This service pays via direct deposit or through checks that are made yourself.

There is no time tracking service that is included in this plan unless you pay a fee for the add-on of Paychex Flex Time. This add-on works wonderfully with the payroll service and is easy to navigate. There is also an extra fee for taxes to be filed.

PayChex Flex is a good fit for small businesses that are just looking for an easy and quick way to do payroll. The way that the PayChex Flex plans work is easy to just pay for the add-ons that are needed for your company so you wouldn’t be paying extra for things that you don’t need. If you need a service that has more benefits, this is not the service for you.

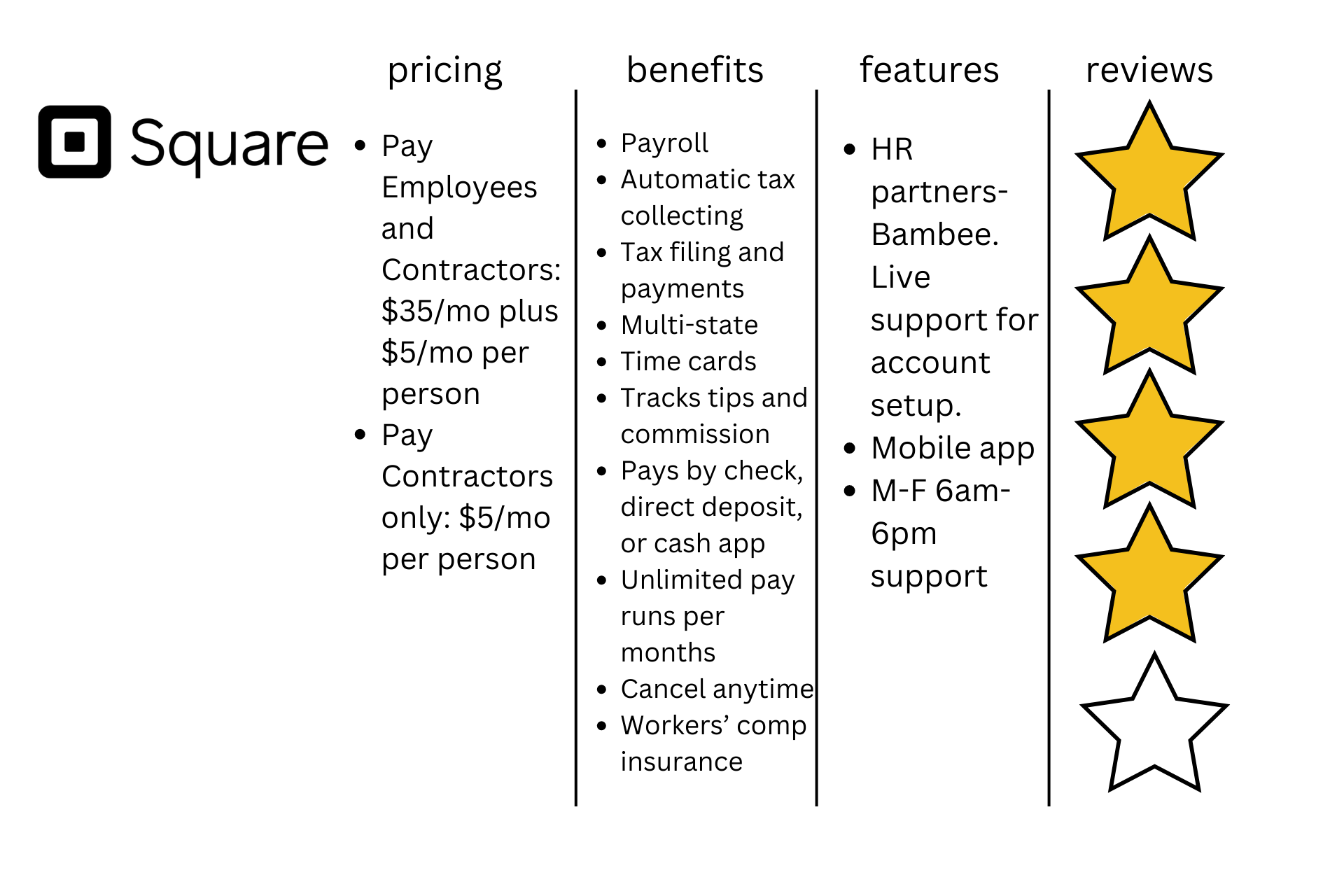

Square:

This financial service would work well with small start-ups to large companies. If you are just paying contract workers there is no subscription fee. It would just be $5 a month. If you pay both Employees and Contractors you would have to pay a subscription fee of $35.

Some features include automated payroll and tax collection, pay by cash app, direct deposit, or check. Unlimited pay runs per month. Unfortunately, they are missing integrated accounting and billing features.

There is live support for account setup, time card, and an employee app. Customer service is available Monday-Friday 6am-6pm. All workers would get insurance and HR support through Bambee.

If your company is small and growing this service would be right for you since there is no monthly fee for contract workers only. It is a great company for seasonal workers, contract workers, or people paid hourly.

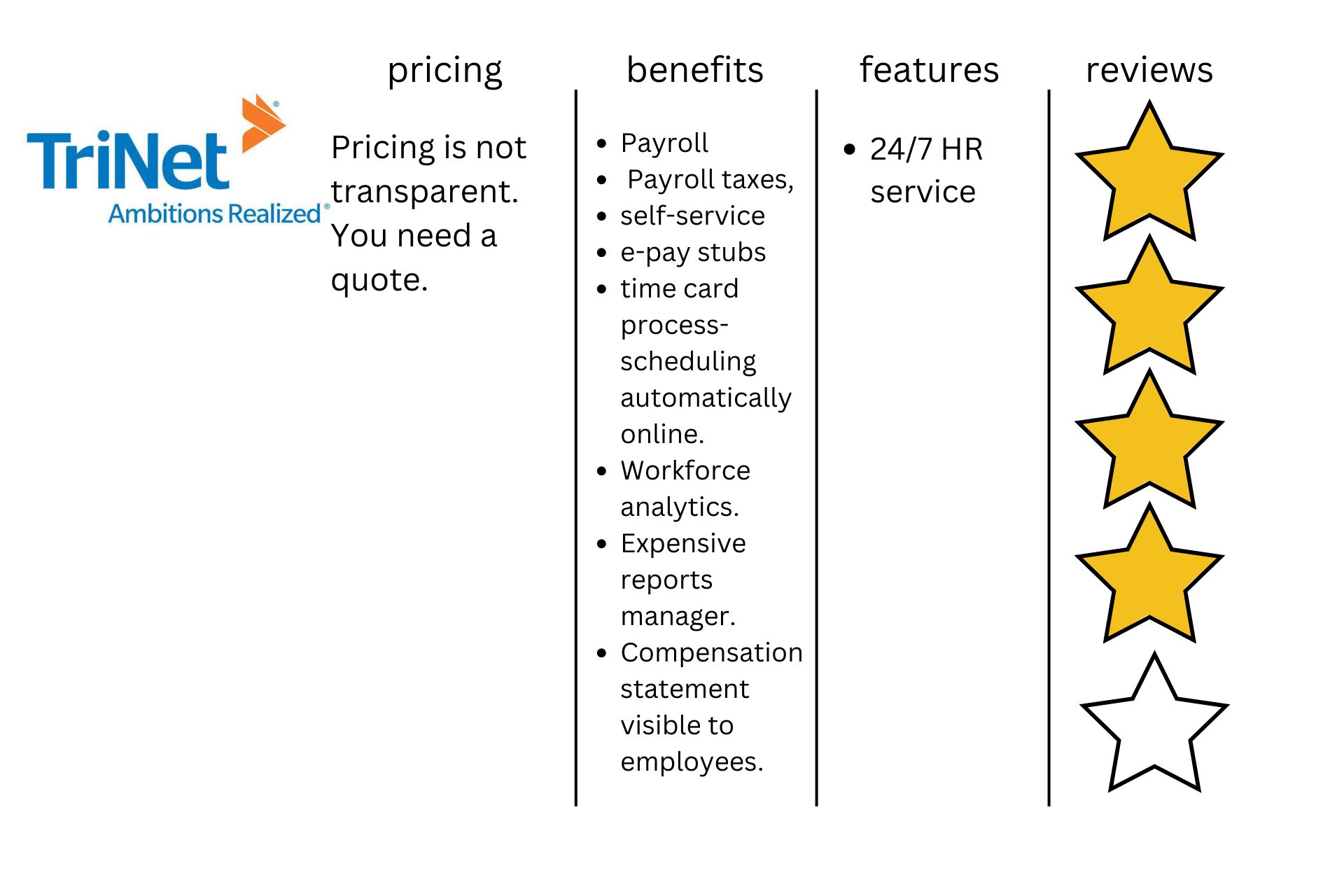

TriNet:

TriNet is a professional employer organization (PEO) meaning that it shares the responsibility of your business so then your employees will join TriNet’s organization and then be leased back to work at your business. This allows business owners to have more time and energy to focus more on growing their business instead of worrying about payroll and other business activities.

The benefits that are included in your plan are basically to make your life easier. They do your payroll, there is a self-service portal with e-pay stubs and time card processes online. There is also 24/7 HR support. In the portal, employers are able to see workforce analytics and see employees’ compensation statements and are able to manage expense reports. Unfortunately, the pricing is not transparent until you talk to a sales representative. Also, there have been bad reviews about customer service not being able to help with simple questions.

This would be a great payroll company for you if you are having trouble with time management and just want some weight to be lifted off your shoulders so you can focus more on your company growing. But remember a PEO isn’t for everyone. If a PEO isn’t needed there are much more affordable options out there for payroll purposes.

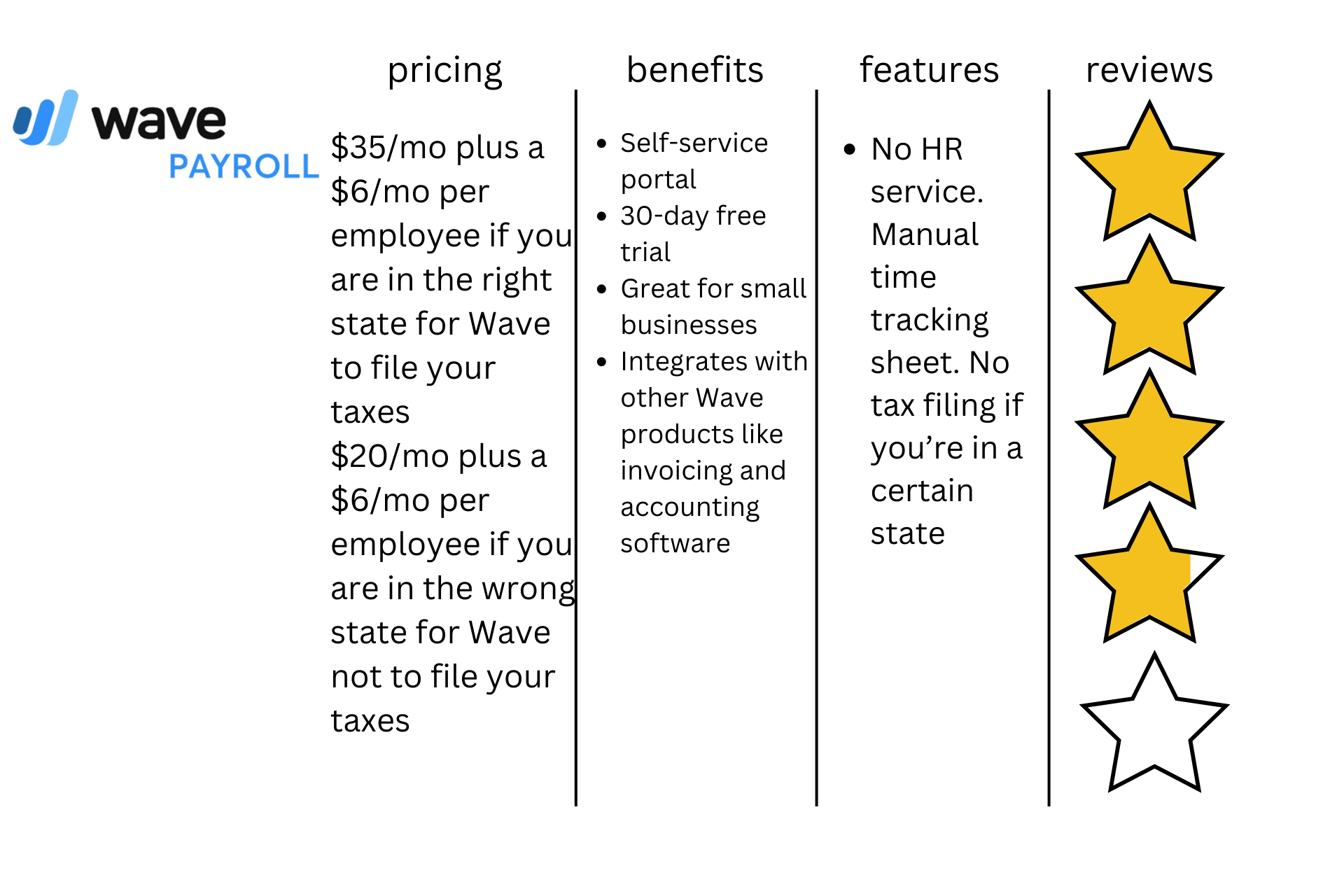

Wave:

Wave is a good payroll service for small companies, especially with seasonal and contract workers. Wave can put those workers on hold while they are not working so the payroll will not run for them.

Included is a self-service portal, a Wave suite where you could put add-ons to your payroll financial business plan. Unfortunately, they have a manual time tracking sheets, there are no HR services, and they don’t file your taxes if you’re in one of the wrong states. You would have to pay a bit extra to have them filed if you were in the right state and you would have to pay a little less if you lived in the wrong state except you would have to file your taxes yourself.

If your business is small or it’s a startup then Wave Payroll might be right for you. If you have a fluctuating roster of employees and contractors then wave is perfect because it’s affordable and when you have the occasional contract workers or seasonal employees you can put those people on hold with Wave so payroll will not run for them. If you use the add-on apps with Wave, they work well together.

How Do You Find the Right Payroll Service for You?

Consider a couple of questions before choosing which one would fit your business:

- How much money can you spend each month?

- How many employees do you have?

- What kind of employees do you have, (hourly/salary/contract/seasonal)?

- What kind of payment do your employees take? (check/direct deposit/Cash App/PayPal)?

- What benefits do you want to have included?

- Will your current payroll integrate smoothly with your next?

- How often do you run payroll?

How Did We Rate these Payroll Services?

We made the ratings based on:

Pricing: Different pricing tier options, free-trial or not.

Benefits: General benefits they had such as a self-service employee portal, apps, online resources, analytics, third-party integration, add-ons, and insurance.

Features: HR support and customer service hours, live, an automated system, or a bot.

Reviews: Customers’ ratings on G2. What kind of experience they have had using the service,

Popularity: The number of clients each company had.

Every Payroll Service is different and you should choose the one that works the best for your company. Consider these popular payroll services for your small to medium-sized companies. They all have different features for small business needs and the competitive prices make it hard to decide. Hopefully, this article makes your decision a lot easier. If you’re a small trucking company, Superior Trucking Payroll Service will definitely be the company for you since the company is very niche and focused on the customer. You will always be able to have the best customer service and a great price.

Written by Tessa Braybrook

Tessa joined Superior Trucking Payroll Services in September of 2022 after graduating with a Bachelor’s degree in multimedia journalism from Grand Valley State University. She has a passion for writing and binge watching TV series.

Contact Us!

How Do I Pay Myself If My LLC Is an S-Corp or C-Corp?

How do I pay myself if my LLC is taxed...

Read MoreMarch 2025 Driver Pay Update for Trucking Companies

Are your drivers leaving for better pay? Are you wondering...

Read MoreThe Hidden Payroll Scam Costing Trucking Companies Thousands

Would You Notice If Your Payroll Was Paying Someone Who...

Read More7 Smart Money Moves to Keep Your Trucking Company Profitable

Are you constantly waiting on payments while your bills pile...

Read More