If you’ve ever bounced over a deep pothole in early...

Read MoreYes, but access to services through QuickBooks Desktop 2019 software will be discontinued after May 31st, 2022, so you will need to transition your desktop data to QuickBooks Online. For more information about the transition, and details about QuickBooks online, you can check out this article where we go over the changes more in-depth.

You have to be well versed in both QuickBooks and payroll in order to customize the way you pay your drivers. If not, you might accidentally input a pay code that is not subject to specific taxes, like FICA or SUTA, which would result if those taxes not being withheld.

If you use QuickBooks Online to do your payroll, there is no one double-checking your work to make sure that you don’t make mistakes. Our payroll service on the other hand act as guardrails for your company by making sure that your payroll is run correctly every time.

As stated previously, if you are knowledgeable in both payroll and QuickBooks processes, correcting errors should be easy. Problems arise when small business owners, who don’t know these things, make mistakes.

If the error is made and discovered quickly, it can usually get corrected.

However, if an error is made and it takes you three months to discover it, you will need to calculate how much taxes were not paid and file a Form 941-X in order to fix the mistake.

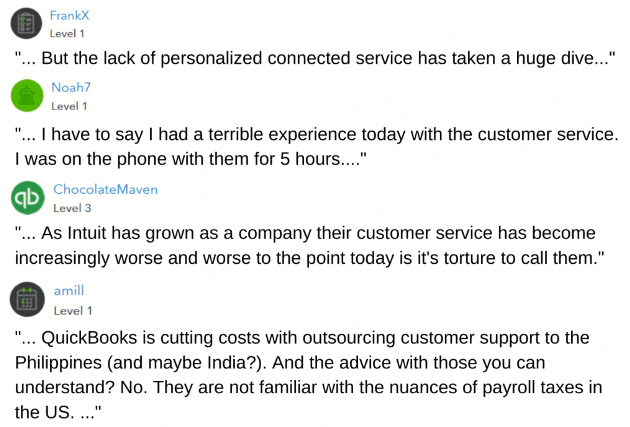

QuickBooks does have resources to use in order to correct errors, but their customer service representatives may not be as helpful as one would hope.

Yes, but you have to buy, print, and file the forms yourself. If you have 1099 drivers you will have to go through each account and vendor and indicate that it should be paid via 1099.

It’s also important to consider that QuickBooks will print your W-2’s based on the data you input. So if there is an error in your payroll, your W-2’s (or 1099’s) will be incorrect as well.

If you choose to have Superior Trucking Payroll Service process your payroll, we take care of all the tax forms for you. There is no extra fee, and we also file and pay your payroll taxes.

Contact Us!

Is Superior Trucking Payroll Service Worth the Higher Cost?

You’re Not Just Buying Payroll — You’re Buying Peace of...

Read MorePayroll for Trucking Companies: We Help Your Whole Trucking Family Get Paid

If you’ve heard of Superior Trucking Payroll Service, you’ve probably...

Read MoreHow Do I Pay Myself If My LLC Is an S-Corp or C-Corp?

How do I pay myself if my LLC is taxed...

Read MoreMarch 2025 Driver Pay Update for Trucking Companies

Are your drivers leaving for better pay? Are you wondering...

Read More