Would You Notice If Your Payroll Was Paying Someone Who...

Read MoreIt’s a question we hear often, and it’s a valid one. When you’re already dealing with the complexities and hidden costs of payroll management, a setup fee can seem like just another tacked-on fee.

Superior Trucking Payroll Service has been committed to supporting our clients for over 15 years. As the first and only payroll service in the U.S. that focuses on trucking companies, we understand the unique challenges you face that come with managing payroll for a trucking company. The complexities of payroll processing, tax filings, and compliance can be overwhelming. We are here to help!

In this article, you’ll discover why our setup fee is necessary and how in the long run it saves you time and money. Let’s explore the details of our setup fee and see why it’s a valuable investment.

The Risks of Incorrect Payroll Implementation

Imagine your payroll system being set up incorrectly. The results can be disastrous, leading to a cascade of issues that affect your entire business. Here are some tangible bad things that can happen:

Compliance Issues

Incorrect payroll setups can lead to compliance violations. This means you could face hefty fines and penalties from federal and state authorities. Nobody wants to deal with audits and legal troubles just because of a setup mistake.

Payroll Errors

When payroll is not set up correctly, it can result in employees being paid incorrectly. Overpayments, underpayments, or missed payments can lead to unhappy employees and high turnover rates. This disrupts your operations and affects morale.

Tax Filing Problems

Incorrect payroll setup can cause errors in tax filings. This might lead to inaccurate tax returns, late payments, and penalties from the IRS. These tax issues can be costly and take a long time to resolve.

Increased Workload

Fixing errors caused by an incorrect setup can be a nightmare. It means spending more time and resources correcting mistakes and taking your attention away from other essential tasks. This increased workload can strain your office staff and reduce overall efficiency.

The Importance of a Professional Setup

By charging a setup fee, we ensure that your payroll system is implemented correctly from the start. Our experienced team takes the time to understand your specific needs and configures the system to comply with all regulations. Here’s what you get with our professional setup:

- Accurate Configuration: We ensure that all payroll components, including tax rates, deductions, and employee classifications, are set up accurately.

- Compliance Assurance: Our setup process includes checks to make sure you comply with federal, state, and local laws, reducing the risk of fines and penalties.

- Ongoing Support: After the setup, we provide continuous support to address any issues and ensure your payroll system runs smoothly.

Investing in a proper setup is not just about avoiding problems; it’s about ensuring peace of mind and allowing you to focus on growing your business. Superior Trucking Payroll Service is here to take the burden off your shoulders and provide a reliable, efficient payroll solution.

Understanding the Payroll Setup Fee: Costs and Inclusions

At Superior Trucking Payroll Service, our one-time fee begins at $300 and covers crucial tasks for seamless payroll management.

- Setting up your payroll system and registering for payroll taxes.

- Linking existing tax accounts for seamless reporting and payments.

- Entering employees' year-to-date information for accurate payroll records.

- This accurately displays employees' complete earnings, and deductions, on their paystubs.

- This also helps us report your quarterly and yearly taxes accurately. Tracking this data is crucial when preparing W-2 forms and detailed payroll summaries. It keeps your payroll and taxes in line without any problems.

Key Factors Affecting Your Payroll Setup Fee

The setup fee at Superior Trucking Payroll Service can vary based on a few things, and they all tie back to how much work is involved. These inclusions ensure your payroll is set up accurately. Now, let’s discuss the factors that influence the cost.

Number of Employees

One big factor is how large your payroll is and how many people are on it. Bigger payrolls need more setup work, which affects the cost. This typically evens out to a $5 increase per employee.

Timing of Payroll

Another large factor to consider is the timing of your first payroll. The setup fee can vary significantly based on when you start.

For example, if a company with 5 employees begins their first payroll at the beginning of a calendar year, the setup fee is $300. However, if that same company starts payroll mid-month and mid-quarter, the setup fee increases to $480.

Now, let’s consider a larger company with 25 employees. If they start their first payroll at the beginning of the calendar year, the setup fee is $500. Starting mid-month and mid-quarter, the setup fee rises to $801.

Why does this timing matter?

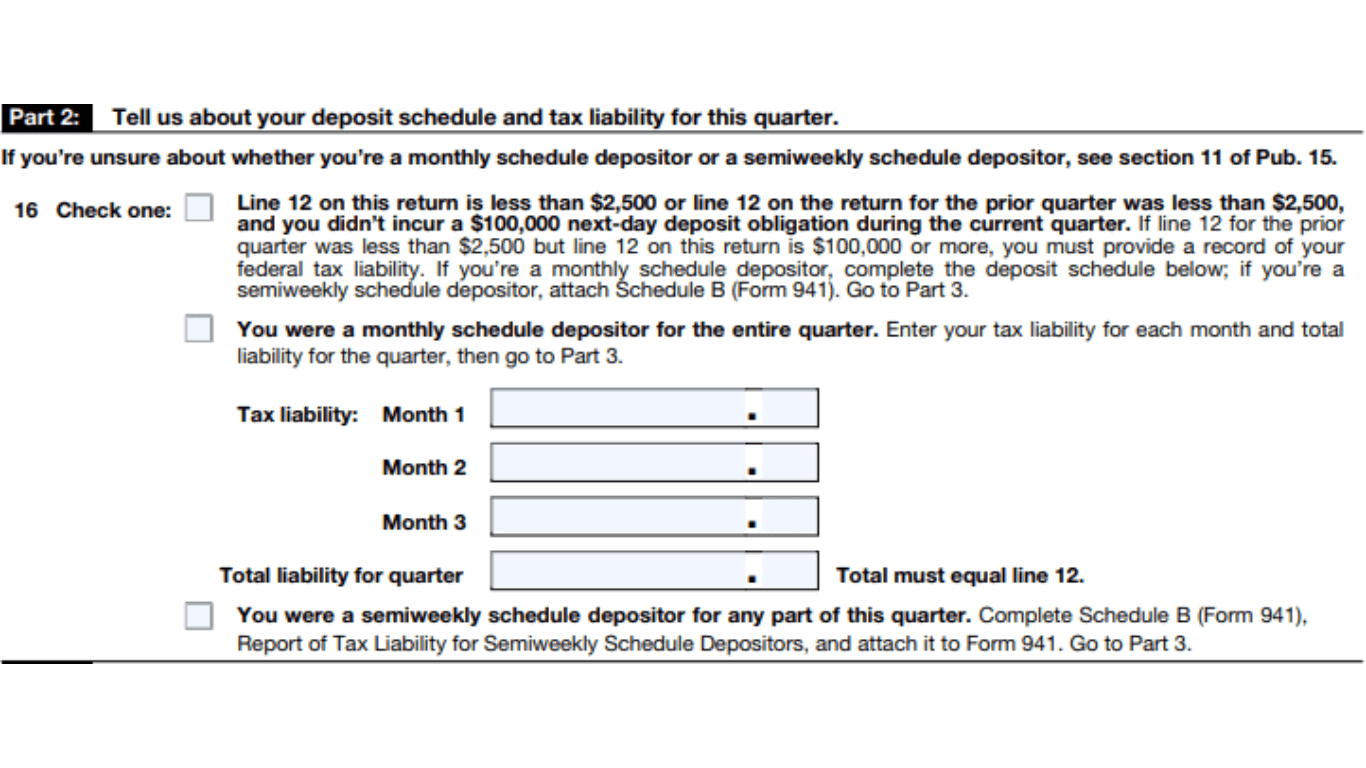

The timing affects how quarterly taxes are reported to the IRS. To understand this, you need to know that there are two ways the IRS requires companies to file their 941 taxes:

-

Monthly Depositor:

If you are a monthly depositor, your 941 form will break out the tax amounts for each month.

-

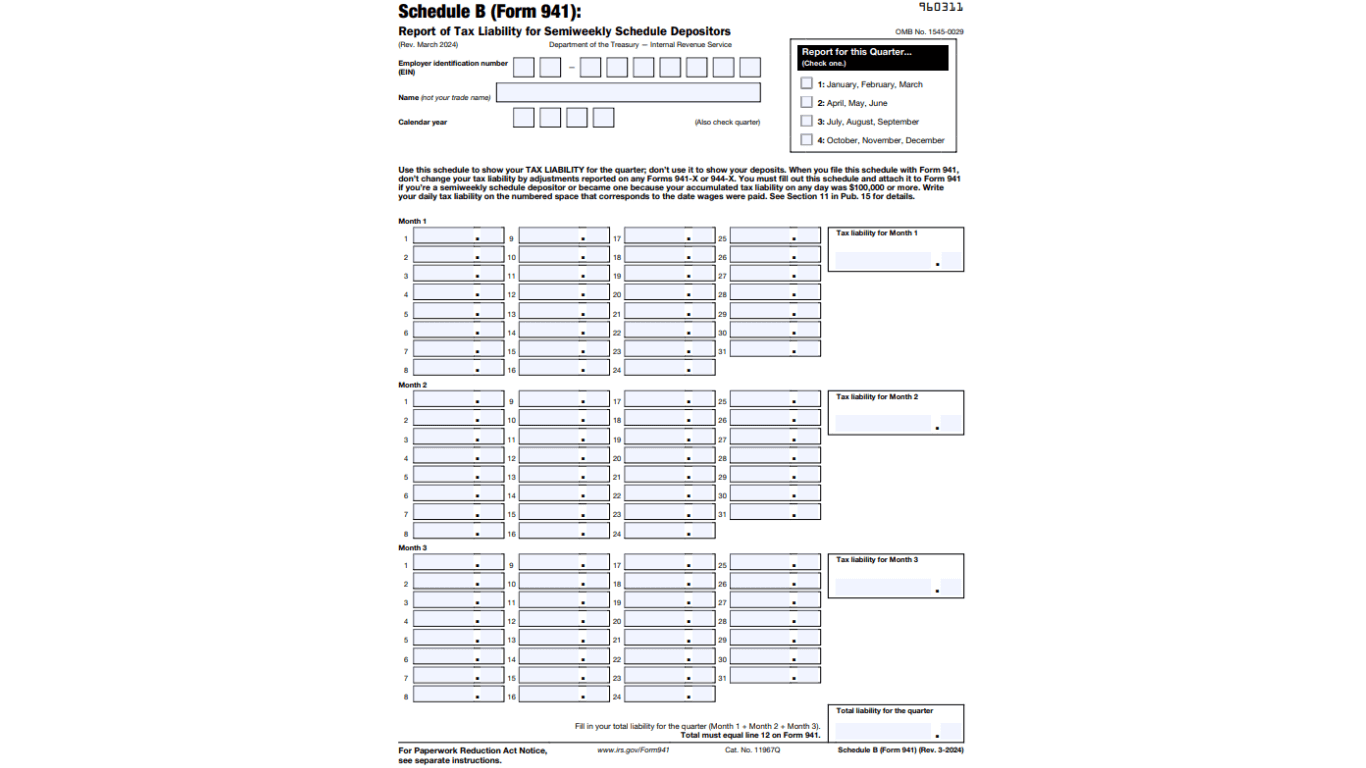

Semi-Weekly Depositor:

If you are a semi-weekly depositor, the tax amounts for each payroll must be reported on the Schedule B page of the 941 form. This means each payroll run must be shown separately.

The IRS determines whether you are a monthly or semi-weekly depositor based on the four quarters that end on June 30 of the prior year. If the tax was over $50,000 for this period, you are a semi-weekly depositor. If the tax was $50,000 or under, you are a monthly depositor.

Monthly reporting on form 941

Semi-weekly reporting on form 941

Impact of Timing on Setup Fees

Starting payroll mid-month or mid-quarter complicates the setup process, especially for semi-weekly depositors.

Here’s why:

-

Monthly Depositor Example:

If a company starts payroll mid-month and mid-quarter, and they are a monthly depositor, the setup fee will be $480. This higher fee covers the additional work required to ensure that all monthly tax amounts are accurately broken out and reported.

-

Semi-Weekly Depositor Example:

For a semi-weekly depositor starting payroll mid-month and mid-quarter, the setup fee will be $700. This is because each payroll needs to be entered and shown separately on the Schedule B page of the 941 form, greatly increasing the time and effort involved in the setup.

Starting payroll at the beginning of a calendar year is simpler because it aligns with the start of a new tax reporting period. When starting mid-month or mid-quarter, there is more historical data to input and verify, which adds complexity and increases the setup fee.

Working in Multiple States

If your business works in multiple states with different tax rules, this can also cause the setup fee to increase. We will need to set up our system to follow each state’s regulations that you’re operating in. Each state has its own rules and reporting schedules that will need to be followed. The more states a company operates in, the more time we spend to make sure all regulations are followed and filings are compliant.

Account Linking Needs

If your business is registered for payroll taxes, part of the fee applies towards linking our systems with your tax accounts. This ensures that payments and reports are seamless and accurate, following local and federal rules.

Considering all these factors allows our setup fee to match your payroll needs exactly. We’re clear about what it costs and what you get, so there are no surprises.

How do you lower your Payroll Set-Up Fee?

Unfortunately, there are not many ways you can lower the set-up fee.

Calculate Your Setup Fee Today!

Want to know how much your payroll setup will cost? Use our Price Estimator to find out! Enter the number of people you pay, how often you pay them, and when you plan to start. Our tool will calculate your set-up fee and show you our regular service fee. Take the guesswork out of payroll setup—get your personalized estimate now!

Price Estimator ToolIn summary, our setup fee ensures your payroll is accurate and compliant from day one. Remember, the setup fee covers crucial tasks like tax registration and linking existing accounts. Ready to calculate your setup fee? Use our Price Estimator tool or contact us today to learn more about how we can help your business thrive. Superior Trucking Payroll Service is here to simplify your payroll process.

Written by Melisa Bush

With over 15 years of experience in the trucking industry, Melisa is well-versed in the complexities of trucking payroll and adept at navigating special circumstances. Before joining Superior Trucking Payroll Service, Melisa worked at a trucking company, where she managed driver miles and expenses for a fleet of 50 trucks. This hands-on experience gives her unique insight into the challenges our clients face when preparing their payroll data.

Melisa’s top priority is customer service. She strives to treat each client as an individual with genuine needs, rather than just another number in the system. Her goal is to alleviate the burdens of our clients and make their daily operations smoother.

Contact Us!

7 Smart Money Moves to Keep Your Trucking Company Profitable

Are you constantly waiting on payments while your bills pile...

Read MoreSecure Online Access to Your Pay Stubs and Tax Documents

As a truck driver, you know that every dollar counts....

Read MoreThe Trucking Payroll People Have a New Partner – Trucking Compliance Just Got Easier!

Helping Trucking Companies Find the Best Compliance Solutions DOT compliance...

Read MoreTrucking Wages Rise: February 2025 Driver Pay Index

Why does truck driver pay drop in January? Will the...

Read More