Are you struggling with the complexities of Workers’ Compensation policies, such as an audit or wage reporting? You’re not alone, and Superior Trucking Payroll Service is here to simplify the process for you. Although we don’t sell Workers’ Comp policies, Superior Trucking Payroll Service has been committed to supporting our clients for over 15 years. As the first and only payroll service that focuses on trucking companies, we understand the unique challenges you face.

In this article, we will explain how our tailored services can help you navigate the complexities of workers’ compensation policies, from finding reliable insurance providers to managing audits and reporting accurate data. Our goal is to offer the guidance and expertise necessary for you to confidently manage these tasks, ensuring peace of mind throughout the process.

How We Can Help with Your Workers' Comp

- Referrals

- Reporting

- Audit Help

- Per Diem Program

Referrals

With over 25 years of experience in the trucking industry, we use our deep knowledge and connections to help you find trusted insurance providers. Whether you need a standard policy or a pay-as-you-go option, we can recommend reliable companies. Check out our webpage “Good Trucking People to Know” for more helpful contacts and resources.

Reporting

Superior Trucking Payroll Service assists clients with their Workers’ Comp needs, including reporting weekly payroll wages to pay-as-you-go policies. These policies help trucking companies handle finances more effectively. They ensure accurate premium payments based on actual payroll, unlike traditional workers’ comp policies that are estimated on projected payroll wages and require a 25% deposit upfront. Pay-as-you-go policies improve cash flow and reduce audit risks.

Audit Help

When clients receive audit notifications, we promptly run reports and gather necessary documents, even coordinating meetings with auditors to ensure compliance. Meetings can either be via email or right here in our office. These steps show how we go above and beyond to give our clients the support they need to stay on track and compliant.

Per Diem Program

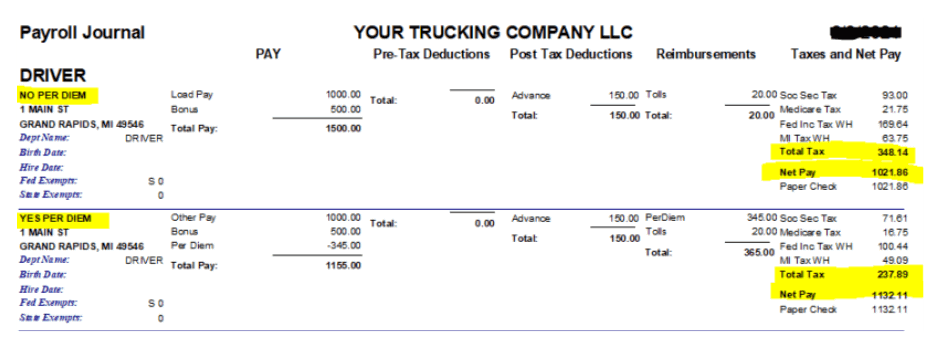

Implementing a Per Diem Program for your truck drivers is another effective strategy for minimizing workers’ compensation costs. These programs allow you to allocate up to $69 per day as non-taxable wages for eligible drivers. This cuts the driver’s taxable income significantly. The wages reported for Workers’ Comp Policies are taxable wages only. This approach can lead to great savings for your trucking company.

Per Diem Programs not only reduce costs but also improve driver retention. With increased take-home pay, your company can offer a more competitive compensation package. This financial benefit not only attracts skilled drivers but also inspires loyalty among current team members. This contributes to a stable and satisfied workforce.

Client Success Stories: Help with Workers' Comp

A real-life example that illustrates the impact of our services.

One of our clients received an unexpected bill from his workers’ comp company, despite paying his yearly premium. Confused and worried, he turned to us for help. As the owner and sole driver covered by the policy, he was surprised by the high charge, especially since he had only worked for three-quarters of the year. Reading through the paperwork he provided, we discovered he had not submitted his audit information. This led the workers’ comp company to apply penalty charges.

We submitted the wage data to the workers’ comp company for him and spoke directly with the auditor to clarify the situation. As a result, the penalty was waived. Additionally, our client received a refund because the reported wages were lower than expected. This success story highlights how our proactive approach, expertise in payroll management, and audit support can make a significant difference for our clients.

Managing Workers’ Comp used to be daunting due to complex paperwork, confusing submission processes, and uncertainty about the required information. Today, with our expert services, we ensure compliance and ease. Looking ahead, you can focus on growing your business with confidence, knowing we have your back. This allows you time to focus on what matters most—running and growing your business.

We here at Superior Trucking Payroll partner with E-COMP Now. E-COMP instantly shops the insurance marketplace, finding the right coverage a the right price for you. It’s possible you could get no-deposit pay-as-you-go workers’ compensation coverage in minutes.

Written by Melisa Bush

With over 15 years of experience in the trucking industry, Melisa is well-versed in the complexities of trucking payroll and adept at navigating special circumstances. Before joining Superior Trucking Payroll Service, Melisa worked at a trucking company, where she managed driver miles and expenses for a fleet of 50 trucks. This hands-on experience gives her unique insight into the challenges our clients face when preparing their payroll data.

Melisa’s top priority is customer service. She strives to treat each client as an individual with genuine needs, rather than just another number in the system. Her goal is to alleviate the burdens of our clients and make their daily operations smoother.