If you’ve ever bounced over a deep pothole in early...

Read MoreStarting a trucking company is a significant achievement, but now comes the daunting task of hiring drivers and setting up payroll. If you’re feeling overwhelmed, you’re not alone. Many new business owners find this process confusing and stressful. But don’t worry; we’re here to help. At Superior Trucking Payroll Service, we specialize in providing payroll solutions tailored to the unique needs of small trucking companies. In this guide, we’ll walk you through each step of setting up payroll, ensuring you have all the information you need to get started.

6 Steps to Setting Up Payroll

- Setting up EINs

- Gather Employee Information

- Completing Company Paperwork

- Customizing Your Paystub

- Choosing Your Pay Date

- Signing Up on TruckingPaychecks.com

Step 1: Setting Up EINs

Before you can hire drivers, you need to set up Employer Identification Numbers (EINs) for your business. An EIN, sometimes referred to as an “Employer Tax ID,” is essential for reporting taxes and other information to the IRS and state agencies.

-

What is an EIN?

An EIN is a unique nine-digit number assigned by the IRS to businesses for tax purposes.

-

How to Apply for an EIN:

You can apply for an EIN online through the IRS website. The application process is straightforward and usually takes less than 15 minutes. Once you have your EIN, you can use it for various tax-related tasks, such as filing payroll taxes and opening a business bank account.

Step 2: Gathering Employee Information

To set up payroll effectively, you need to gather specific information about your employees. In order to keep your business in compliance, make sure you gather this information and create a “driver file” for each driver BEFORE they start working for you. This information includes:

-

Personal Details:

Full name, date of birth, and current address.

-

Employment Details:

Job title, start date, and pay rate. As well as a completed I-9 form.

-

Payment Information:

Bank details for direct deposit, including routing and account numbers.

Our New Client Paperwork includes forms that help you collect this information and stay organized. It’s crucial to keep these documents on hand for each driver or employee you hire.

-

New Hire Information:

This form collects essential personal and employment details.

-

State & Local Tax Forms (click here for a video on Driver Classification)

We recommend hiring drivers as W2 employees, especially if they are driving company equipment. Driver misclassification is a very big deal and could lead to a lot of headaches.

-

Authorization for Direct Deposit:

This form gathers the necessary bank information to set up direct deposit for your employees.

To help you through this process, we’ve created a step-by-step video tutorial. Watching this video will make filling out the paperwork much less intimidating.

Step 3: Completing Company Paperwork

Our Implementation Team will send you all the required paperwork to get started.

Our New Client Packet includes:

-

Service Agreement

This document outlines the terms of our payroll services..

-

Authorization for Direct Payment

This form authorizes us to process payroll payments on your behalf.

-

Employer Conversion Form

This form helps us transition your payroll from any previous provider.

-

State & Local Tax Form

This form ensures compliance with local tax regulations.

Step 4: Customizing Your Paystub

Your trucking company’s paystub should reflect your unique business needs. We believe in offering fully customizable paystubs to our clients. Our Implementation Team will schedule a phone call with you to discuss the details you will want to include. This conversation ensures your paystubs are tailored to your specific preferences.

Here are some customization options you might consider:

- Standard Deductions

- Benefit deductions (health, dental, vision, life, AFLAC)

- Advances

- Solo/Team Miles

- Pickup & Drop off Dates

- To & From City

- Layover

- Stop Off Pay

- Lumper

- Load Number

By providing the load detail on the paystub, your drivers will have a clear and comprehensive understanding of their earnings and deductions. Plus it will cut down on the amount of phone calls your office staff answers each payday.

Step 5: Choosing Your Paydate

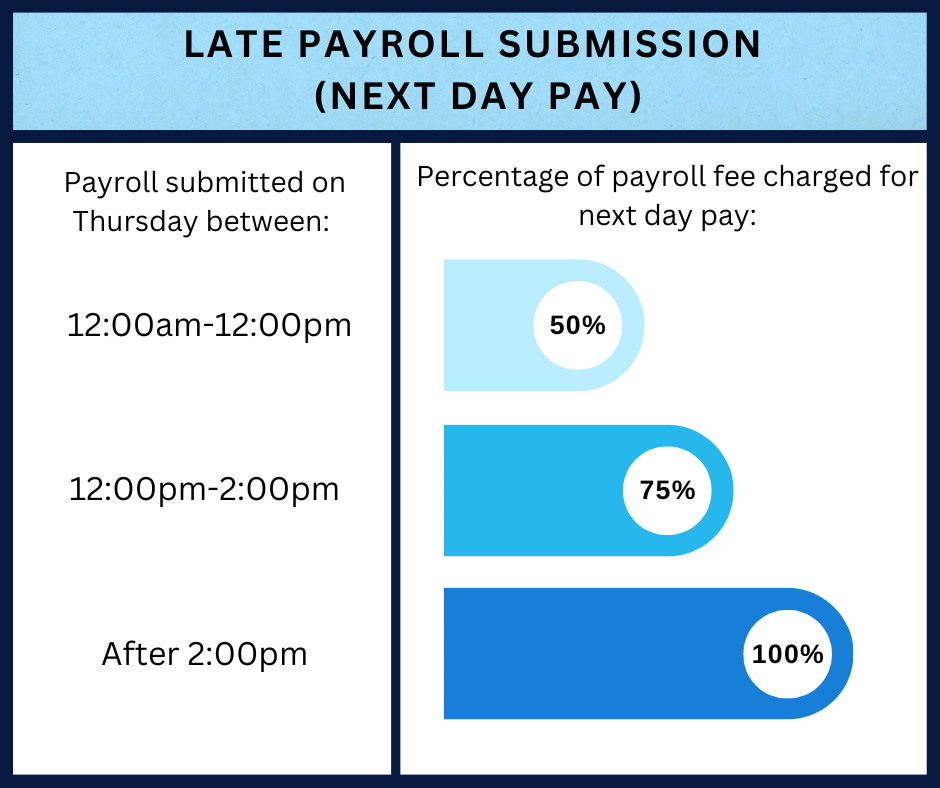

Selecting the right pay date is an essential step in setting up your payroll. Most of our clients prefer a Friday payday, which means they typically submit their payroll data to us on Monday or Tuesday. To avoid late payroll submission fees or Next Day Pay (NDP) fees, make sure your data is submitted by the end of the day on Wednesday for Friday deposits.

We understand that in the trucking industry every company is not the same. That’s why we allow you to choose any day of the week for your payday, Monday through Friday. Just remember that your data submission day will need to be two days prior from your chosen pay date. This flexibility allows you to align your payroll schedule with your business operations.

Step 6: Signing Up on TruckingPaychecks.com

The final step in setting up payroll with Superior Trucking Payroll Service is to have your employees create accounts at TruckingPaychecks.com. This website allows your employees to access all their paystubs in one place and obtain copies of their W-2s or 1099s. This step is not required, but very helpful to your employees.

-

Benefits of TruckingPaychecks.com

Your drivers can easily view their pay history and tax documents, reducing the administrative burden on you and enhancing their satisfaction.

-

How to Sign Up:

Direct your employees to the website and have them follow the simple registration process. Once registered, they can log in anytime to view their pay information.

In Conclusion

Setting up payroll for your trucking company may seem challenging, but with the right guidance and tools, it can be straightforward and stress-free. By following these steps, you’ll ensure your payroll processes are efficient, compliant, and tailored to your business needs. If you have any questions or need further assistance, please contact us using the form below. At Superior Trucking Payroll Service, we’re here to support you every step of the way.

By completing these steps, you’ve taken a significant stride toward successfully managing your payroll and growing your trucking business. Congratulations, and welcome to a smoother, more efficient payroll process!

Written by Melisa Bush

With over 15 years of experience in the trucking industry, Melisa is well-versed in the complexities of trucking payroll and adept at navigating special circumstances. Before joining Superior Trucking Payroll Service, Melisa worked at a trucking company, where she managed driver miles and expenses for a fleet of 50 trucks. This hands-on experience gives her unique insight into the challenges our clients face when preparing their payroll data.

Melisa’s top priority is customer service. She strives to treat each client as an individual with genuine needs, rather than just another number in the system. Her goal is to alleviate the burdens of our clients and make their daily operations smoother.

Contact Us!

Is Superior Trucking Payroll Service Worth the Higher Cost?

You’re Not Just Buying Payroll — You’re Buying Peace of...

Read MorePayroll for Trucking Companies: We Help Your Whole Trucking Family Get Paid

If you’ve heard of Superior Trucking Payroll Service, you’ve probably...

Read MoreHow Do I Pay Myself If My LLC Is an S-Corp or C-Corp?

How do I pay myself if my LLC is taxed...

Read MoreMarch 2025 Driver Pay Update for Trucking Companies

Are your drivers leaving for better pay? Are you wondering...

Read More