If you’ve heard of Superior Trucking Payroll Service, you’ve probably...

Read MoreA Guide for our Clients here at Superior Trucking Payroll Service

In the world of trucking companies, the payroll submission process of weekly payroll can vary greatly. From the size of the company to the utilization of Transportation Management Software (TMS), several factors influence how payroll data is transmitted. At Superior Trucking Payroll Service, we prioritize flexibility, allowing our clients to send their data in the format that works best for them. Whether it’s through email, Excel spreadsheets, or direct exports from TMS software like AscendTMS or McLeod, we adapt to our clients’ needs.

For those companies utilizing TMS software, such as AscendTMS or McLeod, we have amazing news. Both of these systems have exports that make the payroll submission process really easy. AscendTMS, for instance, offers a convenient export feature. It comes directly to us from its driver payroll section, streamlining the process for our clients. Similarly, McLeod provides an efficient export option that can be easily converted into an Excel spreadsheet for payroll processing.

Before You Send Payroll:

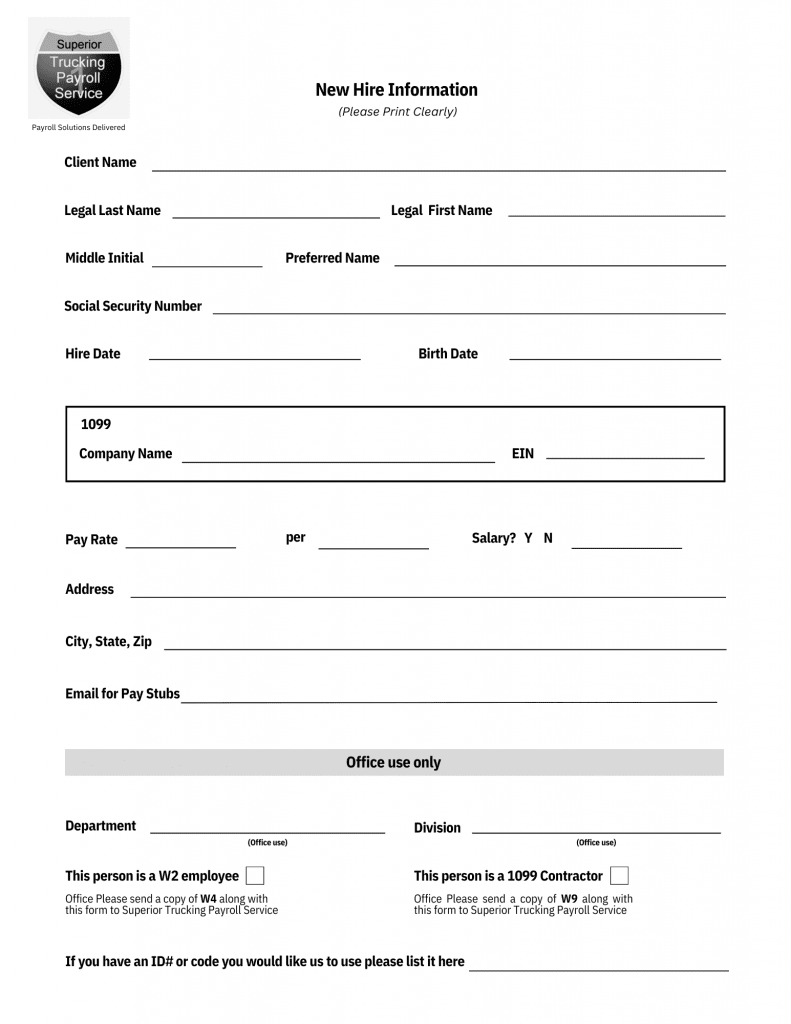

Before initiating payroll submission, it’s crucial to ensure that any new hire information or changes to employee details are communicated promptly. This includes updates to direct deposit information, W4 forms, or benefit deductions. While we recommend sending these changes as soon as they occur, they can also be included along with the payroll data for processing.

Please keep in mind that in order for us to effectively process payroll for new employees, we require all necessary information from you. Without this information, we are unable to ensure timely and accurate payment to your employees. It can be quite disheartening for new employees to not receive their expected pay on payday, leading to uncomfortable conversations and unnecessary stress for both parties involved. Therefore, we kindly request that you provide us with the completed information for all new employees to avoid any complications or misunderstandings regarding payroll.

Submitting Payroll:

At the time of submission, clients are encouraged to send their data to our Processing Team via email at [email protected]. Each of our clients is assigned to a dedicated processor, ensuring personalized attention to their payroll needs. In order to mitigate any potential oversights, we’ve established this centralized email address to ensure no data goes unnoticed, especially if a specific processor is unavailable.

Upon receiving the payroll data, your assigned processor will review it. Any questions or additional information required will be promptly communicated to the client. The processing timeframe varies depending on the complexity of the payroll and the timing of the submission. Clients are encouraged to submit their payroll data as early as possible to ensure the processing timeline. Depending on the timing of submission, in relation to the expected deposit date, there is a possibility of incurring Next Day Pay Fees. These fees are applicable when payroll is submitted the day before deposits and are necessary to cover the expedited processing required to ensure timely payment. Think of this expedited payroll as a “Hot Load”, one that is given a higher priority but with a higher price tag too.

The Review Process:

Once the processor believes the payroll is complete, clients receive a detailed preview for review. This preview provides a breakdown of each employee’s pay, including deductions, reimbursements, and taxes withheld. Reviewing the preview is optional, but it serves as an opportunity for clients to ensure accuracy and address any discrepancies before finalizing the payroll. This is the time to make any updates to ensure no additional revision fees are incurred.

Payroll Approved?

Upon approval of the payroll preview, the processor will proceed to finalize the payroll and generate detailed reports for the client. We offer standard reporting options, but clients can request customized reports as needed. Once finalized, payroll deposits are scheduled with the bank as the client has instructed. Also, Employees receive their paystubs via email, and those enrolled in our Paystub Website can access their paystubs anytime, anywhere.

In conclusion, navigating weekly payroll submission can be a seamless process with the right approach and support. At Superior Trucking Payroll Service, we prioritize client satisfaction and efficiency, ensuring a hassle-free payroll experience for trucking companies of all sizes. With our personalized service and streamlined processes, clients can trust us to handle their payroll needs with precision and reliability.

Written by Melisa Bush

With over 15 years of experience in the trucking industry, Melisa is well-versed in the complexities of trucking payroll and adept at navigating special circumstances. Before joining Superior Trucking Payroll Service, Melisa worked at a trucking company, where she managed driver miles and expenses for a fleet of 50 trucks. This hands-on experience gives her unique insight into the challenges our clients face when preparing their payroll data.

Melisa’s top priority is customer service. She strives to treat each client as an individual with genuine needs, rather than just another number in the system. Her goal is to alleviate the burdens of our clients and make their daily operations smoother.

Contact Us!

How Do I Pay Myself If My LLC Is an S-Corp or C-Corp?

How do I pay myself if my LLC is taxed...

Read MoreMarch 2025 Driver Pay Update for Trucking Companies

Are your drivers leaving for better pay? Are you wondering...

Read MoreThe Hidden Payroll Scam Costing Trucking Companies Thousands

Would You Notice If Your Payroll Was Paying Someone Who...

Read More7 Smart Money Moves to Keep Your Trucking Company Profitable

Are you constantly waiting on payments while your bills pile...

Read More