If you’ve ever bounced over a deep pothole in early...

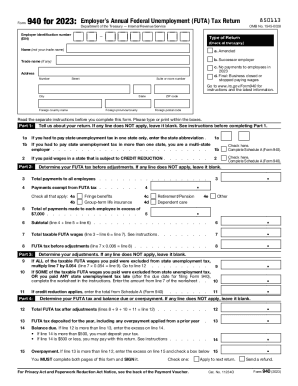

Read MoreForm 940, also known as the Employer’s Annual Federal Unemployment (FUTA) Tax Return, is a crucial document that businesses need to file annually. This form ensures that the federal government has the necessary information to administer and fund unemployment compensation programs for workers who have lost their jobs. Below is a comprehensive guide on what Form 940 entails and how to navigate the filing process.

What is Form 940 and what is it used for:

Use Form 940 to report your annual Federal Unemployment Tax Act (FUTA) tax. Together with state unemployment tax systems, the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs.

Each year, every business with employees must file Form 940 to calculate the amount of unemployment tax that must be paid at the federal level. This payroll tax is based on the first $7,000 of wages of each employee (including owners of S corporations who receive a salary for work performed for their businesses).

Although unemployment benefits for former employees are paid by the states, the federal government provides a backstop. This is done by collecting federal unemployment tax to provide funds to the states when needed to meet their benefits obligations. The Federal Unemployment Tax Act (FUTA) created a payroll tax for this purpose, and IRS Form 940 used to report the employer’s annual tax obligation.

The form is a single one-page return listing the total payments to all employees, reduced by any payments exempt from Federal Insurance Contributions Act (FICA) such as certain fringe benefits, ground term life insurance, and dependent care assistance.

Do I need to file Form 940 for my business?

A business must file Form 940 if it paid at least $1,000 in wages during any calendar quarter in the current or previous year.

If an employer has employees in more than one state it may also have to complete Schedule A of Form 940 to figure the tax if they’re in states that have a credit reduction for wages under unemployment compensation laws.

Your 940 tax form is due at the end of January following the year in which wages were paid.

If quarterly payments are required, they must be deposited with the federal government. This can be done through EFTPS, a free and secure online federal tax payment program.

For small businesses with 11 employees or fewer, annual payment of the tax will suffice because the quarterly payment threshold will not be surpassed.

Filing Form 940:

1. Gather Necessary Information:

Collect essential information such as your Employer Identification Number (EIN), details of your business activities, and accurate payroll records including total payments to employees and payments exempt from FUTA tax.

2. Calculate Your FUTA Tax Liability:

Determine your FUTA tax liability by applying the FUTA tax rate to the first $7,000 of each employee’s annual wages. The standard FUTA tax rate is 6%, but you may qualify for a credit that effectively reduces the rate.

Form 940 filing directions:

1. Enter your business name, address, and Employer Identification number (EIN). If you’re a sole proprietor, enter your name on the “name” line, with your trade name on the “trade name” line. No entry is required on the trade name line if the business’s name and trade name are the same.

2. Indicate the type of return being filed if necessary. This includes checking a box to show it’s an amended return, a return for a successor employer, a return with no tax liability because there were no wages paid during the year, or if the business has closed and stopped paying wages (so the IRS won’t be looking for an unfiled return in the following year).

3. Figure the tax by entering total payments to all employees, reduce this by payments exempt from the tax (e.g., employer payments of health coverage, employer contributions to qualified retirement plans), and then enter the total payments to each employee in excess of $7,000 to arrive at taxable wages. Multiply this amount by 0.006 to determine the tax before adjustments.

4. Make any required adjustments, such as credit reduction amounts described earlier.

5. Determine the final tax due and whether there’s a balance due or an overpayment based on deposits made for the year. If any balance due is $500 or more, it must be deposited (as explained earlier). If the balance due is less, payment can be made along with the return. If there’s an overpayment because too much has already been deposited, it can be refunded or applied to the next return (complete Form 940-V, Payment Voucher) to ensure that the payment is credited to your tax account.

Can it be filed electronically?

The IRS encourages electronic filing, which can be done through their e-file system. If you choose to file by mail, ensure you send the form to the correct address provided in the instructions.

How do I avoid penalties for my business?

- Filing Form 940 by the due date (and making sure it’s complete and accurate).

- Depositing the full amount of federal unemployment tax due when required (and being sure the deposits are honored by your financial institution that payments are drawn upon).

Make sure you keep documentations:

One of the important responsibilities of an employer is keeping track of unemployment taxes and filing the 940 tax form on time. These responsibilities can be simplified with the help of a payroll services provider. We take care of this for our clients, as do most other payroll services. Keep a copy of Form 940 and all supporting documentation for at least four years, as the IRS may request it for review.

Bottom Line:

Filing Form 940 is a crucial responsibility for employers, contributing to the support of unemployment benefits for workers. By understanding the process and meeting deadlines, businesses can fulfill this obligation effectively and stay in compliance with federal tax regulations. For specific details and changes, it’s advisable to consult the latest IRS guidelines or seek professional advice.

Harley joined Superior Trucking Payroll Service in early 2019. Her main roles are Inbound sales, Implementation, and marketing. She loves the work atmosphere.

“It feels like everyone here is a family. Even when we add someone new to the team, they just meld right in.”

Before joining STPS she worked at a local chain grocery store starting in 2013 as a cashier and by the time she left in 2019 was an assistant store director.

Contact Us!

Is Superior Trucking Payroll Service Worth the Higher Cost?

You’re Not Just Buying Payroll — You’re Buying Peace of...

Read MorePayroll for Trucking Companies: We Help Your Whole Trucking Family Get Paid

If you’ve heard of Superior Trucking Payroll Service, you’ve probably...

Read MoreHow Do I Pay Myself If My LLC Is an S-Corp or C-Corp?

How do I pay myself if my LLC is taxed...

Read MoreMarch 2025 Driver Pay Update for Trucking Companies

Are your drivers leaving for better pay? Are you wondering...

Read More