In the trucking industry, drivers often receive separate settlement sheets along with their pay stubs. These settlement sheets show load details only, separate from their wages. This extra document can lead to driver confusion and frustration. Additionally, the extra paperwork for the office to keep track of and distribute can be a burden.

At Superior Trucking Payroll Service, we solve this problem by putting the essential details—like load numbers, miles driven, and accessorial pays—on the driver’s pay stub. Having load detail on the pay stub makes it easy for drivers to see what they’re being paid each week without needing a separate settlement sheet. Our payroll reports and pay stubs are easy to read, but we offer customization if needed.

This article will explain how our reports and pay stubs are designed to be clear and straightforward. We can include important details in pay stubs so your drivers get all the information they need in one place.

Standard Tax Deductions for W2 Truck Drivers

Each driver’s tax situation is different, especially with changing states and miles driven. Our personalized reports include standard deductions like federal and state taxes and match them to each driver’s situation. This way, each pay stub reflects the driver’s unique tax responsibilities.

Standard Tax Deductions for W2 Truck Drivers

Health insurance is vital for your driver’s well-being. Suppose your drivers have selected health insurance through your company. In that case, we ensure the health insurance contributions appear on their pay stubs. Our reports will show the deduction, giving drivers a clear view of their benefits.

Truck Driver Payroll Advances and Deductions

Some drivers may get advances on their pay, and it’s important to track these. We document advances and any related deductions on each pay stub. We can also name the deductions so the driver knows what the deduction is for.

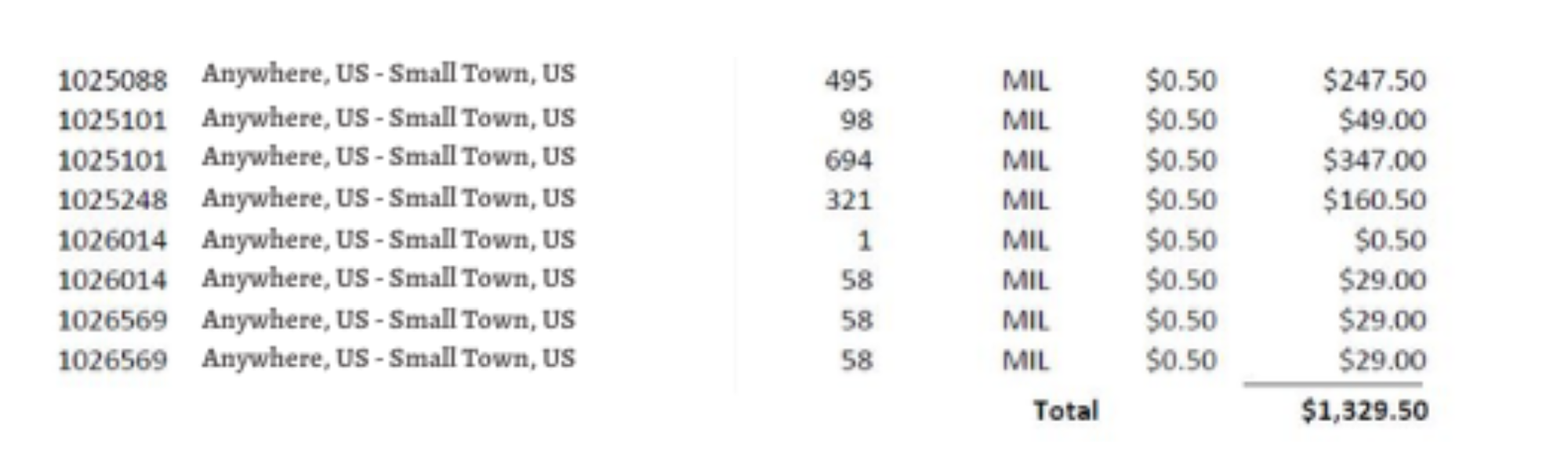

Clear and Easy-to-Understand Truck Driver Load Details

Superior Trucking Payroll Service keeps payroll simple and clear by including load details on pay stubs—if your company gives us the information. These details help drivers track their trips and understand exactly how their pay is calculated.

Load Numbers on Driver Pay Stubs

When your company gives us load numbers, we add them to the driver’s pay stub. This helps drivers match their pay with the loads they moved, reducing confusion and ensuring every trip is accounted for.

Origin and Destination Details on Pay Stubs

We can also include city details for pickup and delivery for each trip. These details help drivers match the load number with the trip details, so they don’t need to call your office with questions. Their pay stub will show the cities the trip started in and finished in, along with the load number, giving drivers a full picture of the completed trip.

Pay Amounts for Each Load on Pay Stubs

We can include the pay amounts for each load on the pay stub. This information will be shown clearly whether the driver is paid by mileage or a percentage of the load. By breaking down how much each load pays, drivers will always know what they earned for every trip.

Including Extra Driver Compensation (Assessorial Pay)

Drivers often do more than drive from one point to another. These extra tasks, called accessorial pay, should be included on the pay stub. We include these extra payments if your company provides the details. This way, drivers can see and understand their total earnings.

-

Layovers:

When a driver waits between loads, we can add the pay for this time to the pay stub.

-

Stop Pay:

If a driver is paid for extra stops, we can show these stops on the pay stub.

-

Lumper Fees:

When drivers pay for lumpers—workers who help load or unload freight—we can include these on the pay stub and ensure the driver sees the reimbursement or additional pay.

-

Unloading Pay:

When the driver is required to help unload the truck, we can also list this extra pay on their pay stubs.

-

Detention Pay:

If drivers wait at a shipper or receiver longer than planned, they get detention pay. This extra pay can also be shown on the pay stub.

Including this accessorial pay ensures drivers see all their earnings beyond just mileage or percentage pay. Seeing these details keeps drivers happy and confident they are being paid accurately.

Simple and Customizable Payroll Reports for Trucking Companies

Our basic payroll reports are designed to be clear, simple, and easy to understand for your company’s office staff. These reports provide all the critical details needed to manage payroll, track payments, and handle deductions correctly.

Suppose your company has specific reporting needs outside our standard package. In that case, we can create customized reports for you. For example, you might need a Journal Entry report to track your payroll expenses for accounting purposes. This report is something we can customize for you.

Most custom reports are free, but more complex ones require a one-time fee. We’ll discuss any charges with you upfront so there are no surprises. Once your custom report is available, it’s yours to use whenever you need it, giving you long-term value.

At Superior Trucking Payroll Service, clear and accurate payroll reports are crucial for your office staff. They make managing payroll and accounting easier by keeping payments, deductions, and financial details organized. Pay stub detail is also crucial. Your truck drivers need to understand their weekly earnings and what they’re being paid for each week. When drivers can easily see details like load numbers, miles driven, and accessorial pay, they trust that they are paid fairly for their work. This detail builds confidence, which helps with driver retention. When drivers feel secure and understand their pay, they’re more committed to your company’s success.

By offering clear payroll reports for your office staff and transparent pay stubs for your drivers, Superior Trucking Payroll Service helps you build a more efficient operation and a loyal workforce.

If you’re looking for a payroll system that simplifies your processes and builds trust with your drivers, Superior Trucking Payroll Service is here to help.

Ready to learn more about how we can take payroll management off your plate?

Check out our article

Payroll Management: What We Do for Our ClientsBefore coming to Superior Trucking Payroll Service, in 2011, Melisa worked for a trucking company with 50 trucks. She was the one who processed the driver’s miles and expenses.

Because of this experience, she understands the challenges our clients go through each week while preparing their payroll data for us. Customer service is #1 for Melisa. Her goal is to treat our clients like people with true and real needs, not just another number.