If you’ve ever bounced over a deep pothole in early...

Read More

For truck drivers operating under a 1099 arrangement, managing taxes is a significant responsibility that demands careful attention throughout the year. Unlike traditional W-2 employees, independent contractors are responsible for both paying taxes throughout the year and settling any remaining tax liabilities at the end. This guide offers insights into how truck drivers can proactively handle their tax obligations under a 1099.

Paying Taxes Throughout the Year:

Estimate Quarterly Taxes:

Independent contractors are typically required to estimate their tax liability and make quarterly payments to the IRS. This involves calculating income, factoring in deductions, and determining the appropriate tax percentage.

Keep Careful Records:

Accurate record-keeping is essential. Maintain detailed records of income, expenses, and deductions. This not only helps you with precise tax calculations but also serves as crucial documentation in case of an audit.

Set Aside Funds:

To avoid a financial crunch during tax season, set aside a portion of each paycheck for taxes. This disciplined approach ensures that funds are available when quarterly tax payments are due.

Paying Taxes at the End of the Year:

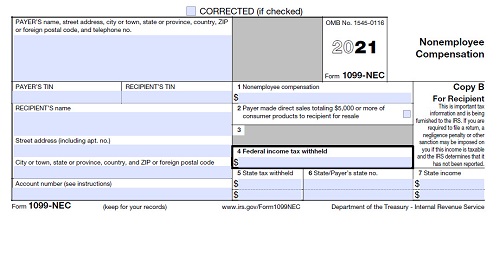

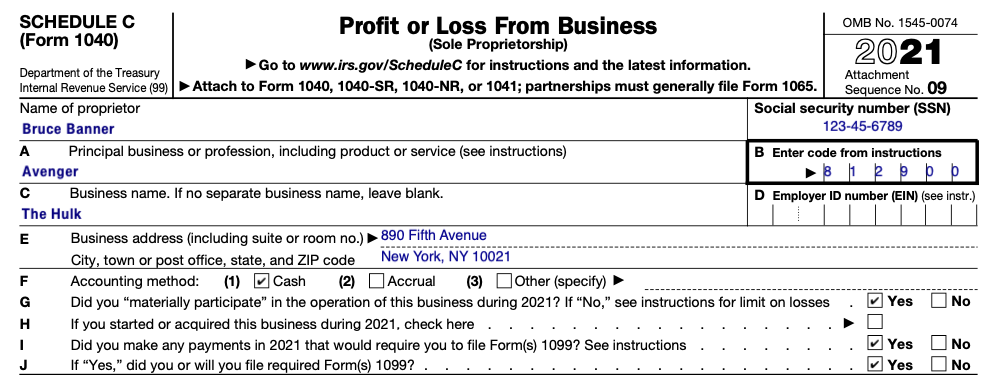

File Annual Tax Return:

Independent contractors file an annual tax return using Schedule C or other appropriate forms. This comprehensive document outlines income, expenses, and deductions. Completing this accurately is critical for a fair tax assessment.

Consider Deductions:

Take advantage of allowable deductions to reduce taxable income. Common deductions for truck drivers include expenses related to fuel, maintenance, insurance, and other business-related costs.

Tax Credits:

Explore available tax credits, such as the Earned Income Tax Credit (EITC) or other industry-specific credits. These can significantly reduce the final tax liability.

Determining How Much to Pay:

Use Tax Software or a Professional:

Consider using tax software or consulting with a tax professional, who understands trucking, to navigate the complexities of tax calculations. These tools can help determine the appropriate amount to set aside for quarterly payments.

Understand Tax Brackets:

Grasp the tax brackets applicable to your income level. This understanding ensures that you’re setting aside an adequate percentage of income for taxes.

Plan for Additional Taxes:

Independent contractors are subject to both income tax and self-employment tax. Factor in both to avoid surprises at the end of the year.

Bottom Line:

For truck drivers operating under a 1099, staying proactive in tax management is key to financial health. By estimating and paying quarterly taxes, maintaining careful records, understanding deductions and credits, and seeking professional advice, independent contractors can navigate tax obligations with confidence. This proactive approach not only ensures compliance but also helps optimize the financial outcomes of their independent ventures.

Before founding Superior Trucking Payroll Service, Mike was the CFO of a trucking company with 80 trucks and a thriving brokerage. This experience gave him the perspective that a payroll solution has to make the lives of the office people better. All the solutions he has designed are to benefit everyone. Our company mission is to help trucking families and that includes the company owners, the drivers, and the office.

Contact Us!

Is Superior Trucking Payroll Service Worth the Higher Cost?

You’re Not Just Buying Payroll — You’re Buying Peace of...

Read MorePayroll for Trucking Companies: We Help Your Whole Trucking Family Get Paid

If you’ve heard of Superior Trucking Payroll Service, you’ve probably...

Read MoreHow Do I Pay Myself If My LLC Is an S-Corp or C-Corp?

How do I pay myself if my LLC is taxed...

Read MoreMarch 2025 Driver Pay Update for Trucking Companies

Are your drivers leaving for better pay? Are you wondering...

Read More