If you’ve ever bounced over a deep pothole in early...

Read MoreIn today’s rapidly evolving professional landscape, it’s increasingly common to find individuals straddling the line between being a business owner and an employee. This unique position offers numerous benefits and opportunities but also carries significant implications for your taxes and benefits. In this comprehensive guide, we’ll delve into the intricacies of being both a business owner and an employee, covering different business structures, payment methods, and the array of benefits available.

Are You a Business Owner and an Employee?

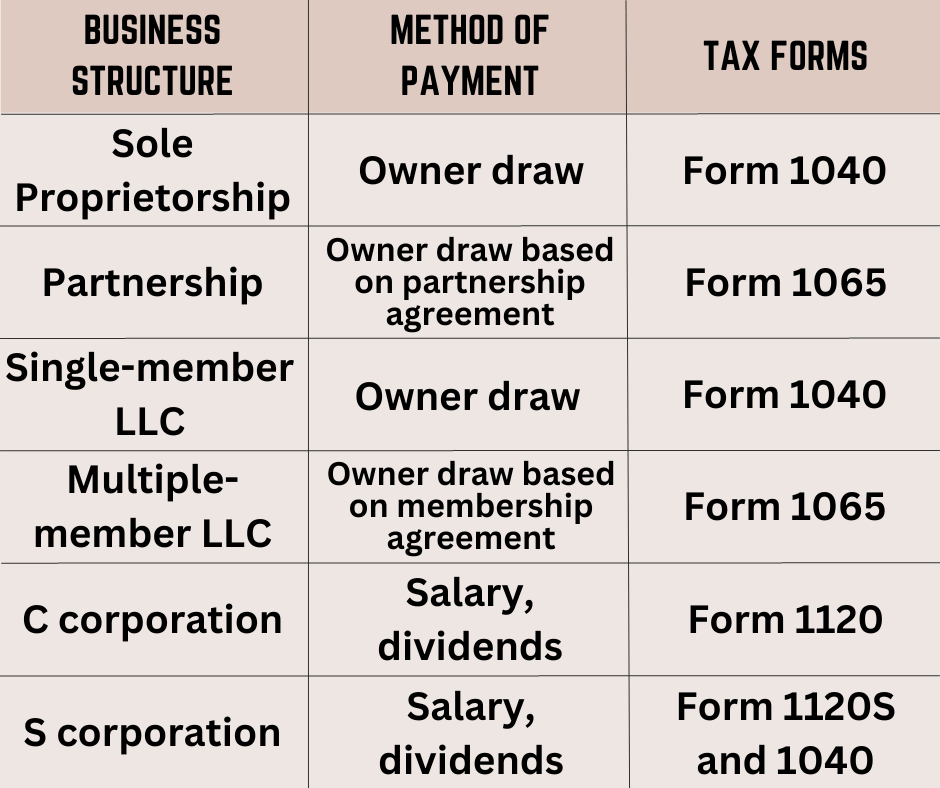

Whether you hold both titles depends largely on your business’s legal structure. Here’s a breakdown of how different business structures affect your identity:

Sole Proprietorship:

You’re the sole owner of an unincorporated business as a sole proprietor. Your business income is considered your personal income, reported on your individual tax return (Form 1040). You are also responsible for self-employment taxes and estimated taxes.

Takeaway: In a sole proprietorship, you’re primarily a business owner, not an employee.

Partnership:

Partnerships involve co-ownership with one or more partners, either as limited liability partnership or a limited partnership.

Takeaway: In a partnership, you’re fundamentally a business owner, not an employee.

Limited Liability Company (LLC):

In a single-member LLC, your business’s profits are considered personal income, and you report them on your individual tax return. Multiple members are treated similarly to partners for tax reporting purposes.

Takeaway: As an LLC member, you’re essentially a business owner, not an employee, unless you choose a corporate tax structure (C-corp or S-corp), as discussed later.

C Corporation (C-Corp):

C corporations are distinct legal entities, providing the highest liability protection. If you work in your corporation as an officer or director, you receive a W-2 for your wages and pay income tax on your personal return. You may also pay taxes on dividends received.

Takeaway: As a C-corp owner, you’re primarily a business owner. However, working for the corporation as an employee means you’re also classified as an employee.

S Corporation (S-Corp):

S corporations have unique tax rules, allowing company profits to pass through to individual income without corporate tax rates, subject to specific criteria. You may also face state-specific tax regulations.

Takeaway: In an S-corp, you’re essentially a business owner. But if you serve as an employee within the company, you carry a dual role as an employee.

Payment Methods for Business Owners

Your business structure also influences how you pay yourself. There are three primary payment methods:

Owner's Draw:

A draw is when you, as a business owner, withdraw funds for personal income, often taken periodically based on cash flow. Draws are not separately taxed but are reported as part of your overall business income on your personal tax return.

Suitable for: Sole proprietorships, partnerships, multi-member LLCs, and single-member LLCs.

Salary:

A predetermined, regular payment issued during each pay period, with taxes automatically deducted from your paychecks. Common for C-corporations and S-corporations.

Suitable for: C-corporations, S-corporations.

Dividends:

Distributions of company profits to shareholders. Generally taxed at a capital gains rate at the federal level, subject to state variations. Applicable to corporations.

Suitable for: Corporations.

Distributions:

Similar to dividends, but used in S-corporations. Taxed differently, with shareholders able to take tax-free distributions up to their company basis.

Suitable for: S-corporations.

Exploring Available Benefits

Your classification as a business owner also determines the benefits you can access:

Health Insurance:

Sole proprietors, partners, and individual LLC members without employees often require individual health insurance. Business owners with employees may be eligible for group health insurance but must be actual employees, not just shareholders.

Workers' Compensation:

State laws govern workers’ compensation, with employers generally required to provide coverage to employees. Coverage for business owners varies by state regulations.

401(k) Plans:

Sole proprietors, partners, or individual LLC members can opt for solo 401(k) plans. Owners of C-corporations and S-corporations may participate in company 401(k) plans if they are common-law employees.

Choosing the Right Business Structure

Your business structure not only influences your income and tax responsibilities but also your eligibility for benefits. When selecting or reconsidering your business’s structure, consider these factors:

Business Goals: Short-term and long-term objectives, such as hiring employees or attracting investors, may influence your choice.

Liability: Assess how much protection you need for your personal assets.

Taxes and Payment: Consider your preferred payment method and desired tax deductions.

Control: Weigh your desire for autonomy and decision-making power.

Consult a Tax Professional

Navigating the complexities of being a business owner and potentially an employee is best undertaken with professional guidance. Consult a business accountant or tax expert to ensure you’re taking the right legal and financial steps to manage your unique situation effectively. Your business’s success and your financial security may depend on it.

If you need anymore information, feel free to contact us or request a quote below.

Before founding Superior Trucking Payroll Service, Mike was the CFO of a trucking company with 80 trucks and a thriving brokerage. This experience gave him the perspective that a payroll solution has to make the lives of the office people better. All the solutions he has designed are to benefit everyone. Our company mission is to help trucking families and that includes the company owners, the drivers, and the office.

Contact Us!

Is Superior Trucking Payroll Service Worth the Higher Cost?

You’re Not Just Buying Payroll — You’re Buying Peace of...

Read MorePayroll for Trucking Companies: We Help Your Whole Trucking Family Get Paid

If you’ve heard of Superior Trucking Payroll Service, you’ve probably...

Read MoreHow Do I Pay Myself If My LLC Is an S-Corp or C-Corp?

How do I pay myself if my LLC is taxed...

Read MoreMarch 2025 Driver Pay Update for Trucking Companies

Are your drivers leaving for better pay? Are you wondering...

Read More