If you’ve heard of Superior Trucking Payroll Service, you’ve probably...

Read MoreOne of the biggest challenges that face the trucking industry is knowing how you and your business are going to be taxed. And I’m sure you’ve asked yourself many times before: “Who pays my taxes and how do I know they were paid?”

We’ve all seen the headlines about a payroll company running off with their client’s tax money. It’s a curse on the payroll profession that a few unethical people make us have to wonder about everyone. And while fraud is not unique to the payroll industry, it does happen with corrupt payroll companies.

Although there are many benefits to outsourcing your company’s payroll functions, it’s crucial to be aware that employers who outsource payroll are still legally responsible for any and all payroll taxes due.

According to the IRS, “An employer’s use of a Payroll Service Provider (PSP) does not relieve the employer from its responsibility of ensuring that all of its federal employment tax duties are met. A PSP assumes no liability for their employer/clients’ employment tax withholding, reporting, payment, and/or filing duties.”

Access your Electronic Federal Tax Payment System (EFTPS) Account:

EFTPS is a free website from the Treasury Department that gives employers easy access to their deposit history, as long as payments are being made using their Employer Identification Number (EIN).

If you’ve already signed up for EFTPS and have a pin number you can log in and view your payroll tax deposit records:

① Go to www.eftps.gov

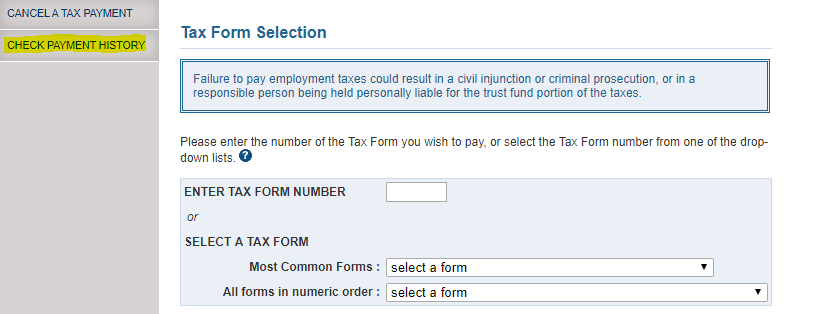

② Click ‘payments’

③ Login with your EIN, PIN, and password

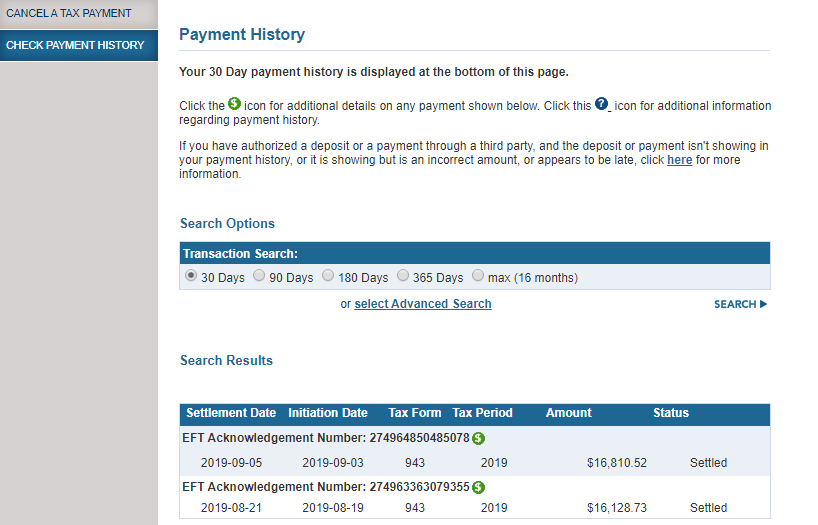

④ Click ‘check payment history’

⑤ Search for tax payments, the tax form should be 941

If you’re not already signed up for EFTPS:

① Go to www.eftps.gov

② Click ‘enroll’

③ Agree to the terms and pick the type of entity

④ Fill in the necessary information

⑤ You will receive your PIN by mail

⑥ Follow the instructions above to login and access your records

Access Your State Tax/ Treasury Account:

The EFTPS portal is only for federal tax payments, and some states have their own process for employers or payroll service providers to submit their tax deposits and access their transaction history:

If you suspect your payroll service provider of fraud involving your federal taxes being deposited or involving filing your tax returns, you can submit a complaint using Form 14157 Complaint: Tax Return Preparer.

Before founding Superior Trucking Payroll Service, Mike was the CFO of a trucking company with 80 trucks and a thriving brokerage. This experience gave him the perspective that a payroll solution has to make the lives of the office people better. All the solutions he has designed are to benefit everyone. Our company mission is to help trucking families and that includes the company owners, the drivers, and the office.

Contact Us!

How Do I Pay Myself If My LLC Is an S-Corp or C-Corp?

How do I pay myself if my LLC is taxed...

Read MoreMarch 2025 Driver Pay Update for Trucking Companies

Are your drivers leaving for better pay? Are you wondering...

Read MoreThe Hidden Payroll Scam Costing Trucking Companies Thousands

Would You Notice If Your Payroll Was Paying Someone Who...

Read More7 Smart Money Moves to Keep Your Trucking Company Profitable

Are you constantly waiting on payments while your bills pile...

Read More