Would You Notice If Your Payroll Was Paying Someone Who...

Read MoreWow! You have hired your first employee! But oh no, how are you going to pay them? You need to set up payroll for them. How does that work though? In this article, we will discuss the things you should know before jumping right into the depths of payroll. You first need to know what pay periods and paydays are and how you should schedule how your employee(s) get paid.

What is a pay period?

A pay period is a time frame of a certain amount of days when the employee’s work is tracked and then paid recurringly. This is based on a schedule made by the company. There are different lengths of time pay periods can last. Employees can be paid, weekly, bi-weekly, or monthly. These different lengths give you the option to pay your employees at a time that is beneficial for them.

How long is a pay period?

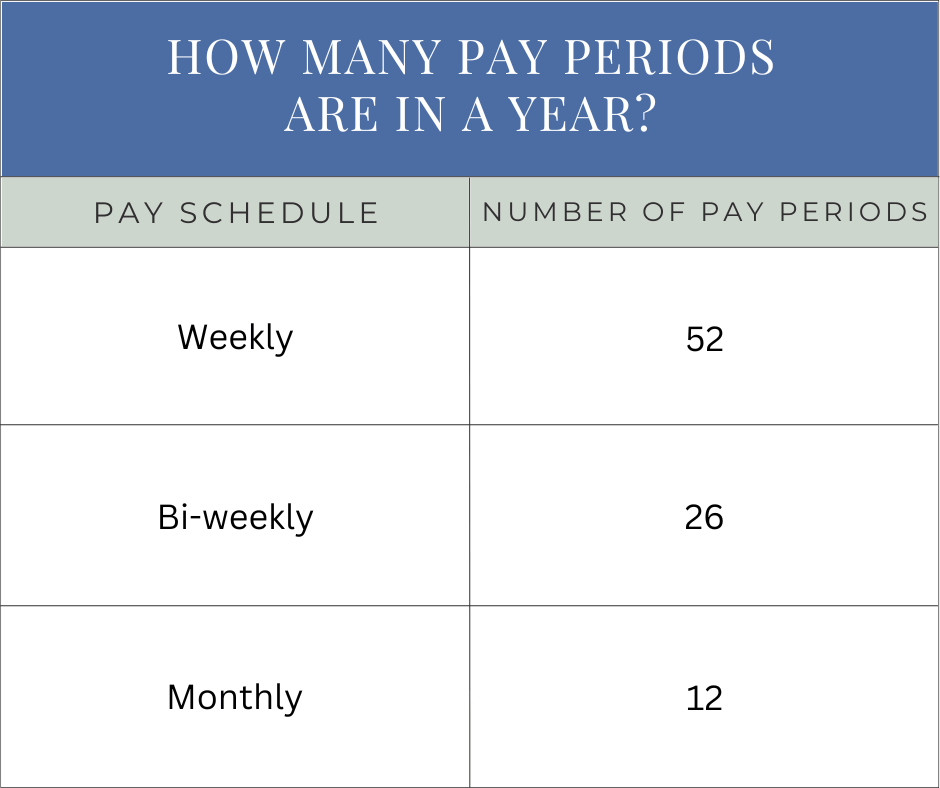

The company’s pay period lengths depend on its selection for the calendar year. Some typical pay periods are listed below:

Weekly Pay Period:

Just like it sounds, a weekly pay period is a week long. A weekly pay period is always seven days long even though the typical work week is five days, Monday through Friday.

Bi-weekly Pay Period:

A bi-weekly pay period is two work weeks long. This would be 14 days. So as an employee, you would get paid every other week.

Monthly Pay Period:

A monthly pay period is one month long. So it depends on the month of what date you would get paid.

How is a pay period calculated?

A company decided what pay period length they want to run their payroll on what is most beneficial for them and their employees. This decision is made based on factors how often employees need money or how the employees are paid such as hourly, salary, percentage of the load, or by the mile.

Companies that mostly have hourly workers or contract workers that are paid by the mile or the percentage of the load will find it most beneficial to have a weekly or bi-weekly pay period. Companies that mostly have salaried employees might find it more beneficial to pay bi-weekly or monthly.

How many pay periods are there in a year?

What is a pay day?

A payday is the date on which companies pay their employees for their pay period. The most common day to have paydays are Friday. For tax purposes, your paydays are used to determine the period in which you need to pay and file payroll taxes. Payroll takes a few days to process so the pay date for the current pay period will most likely be on the last day of the following pay period instead of the last day of the pay period the employee just worked.

Bottom line:

Scheduling out your payroll processing isn’t very hard at all. You just need to take into account what would be most beneficial for the employees and the company. Paydays on Friday are normally the most beneficial. For most trucking companies, processing your payroll weekly is the best way to go because the employees will be paid often for the loads that they carry. To learn more about how you can start payroll, check out our Payroll 101 series. If you want to start processing payroll with us, visit our services page to get all the details and then request a quote.

Contact Us!

7 Smart Money Moves to Keep Your Trucking Company Profitable

Are you constantly waiting on payments while your bills pile...

Read MoreSecure Online Access to Your Pay Stubs and Tax Documents

As a truck driver, you know that every dollar counts....

Read MoreThe Trucking Payroll People Have a New Partner – Trucking Compliance Just Got Easier!

Helping Trucking Companies Find the Best Compliance Solutions DOT compliance...

Read MoreTrucking Wages Rise: February 2025 Driver Pay Index

Why does truck driver pay drop in January? Will the...

Read More