Are you 100% sure you’re handling per diem correctly in...

Read MoreSo you want to know how much payroll costs?

Well the answer to that is it depends. Do you pay your drivers weekly? Bi-weekly?

We recommend that you pay weekly, if not more frequently than that.

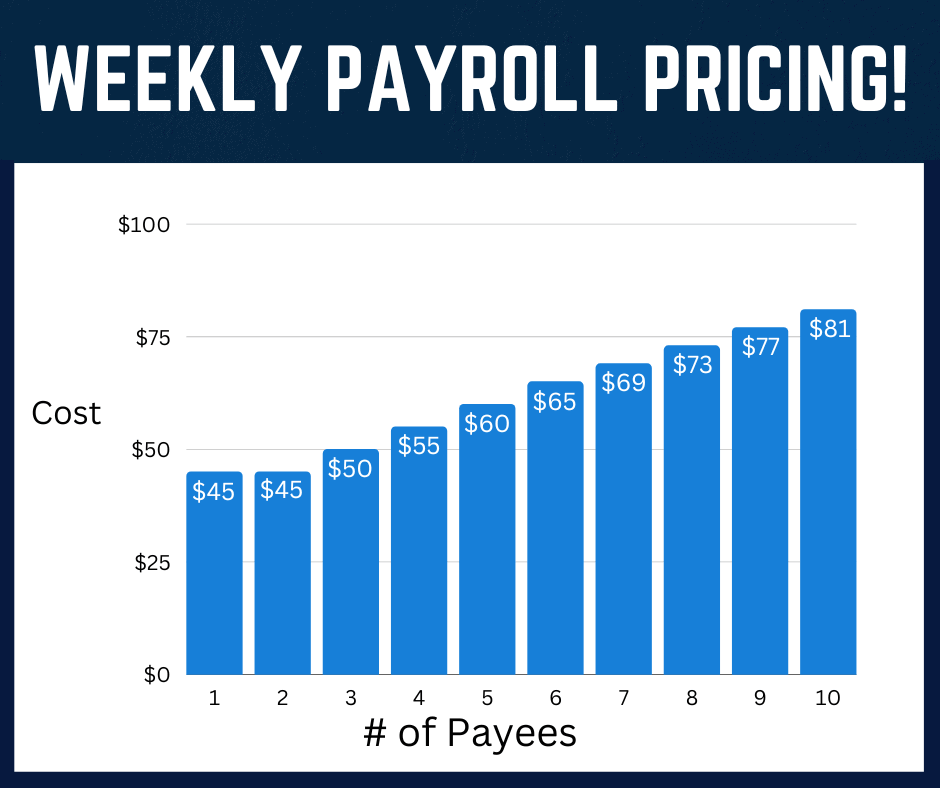

Our pricing is typically based off of weekly pay. Our base rate is $45 and that covers up to two employees.

If you add an additional employee it goes up by $5. So three employees is $50, four employees is $55, and so on.

If you’re a larger company then your price per employee could be a little bit lower.

Included in that price is garnishment remittance, tax calculations, direct deposits to multiple accounts, paystubs emailed to your employees, along with uploaded to our paystub website if they sign up. And their W-2’s or 1099’s printed, so there’s no extra charge at the end of the year.

Additional Fees:

State Tax Set-Up:

• If you set up state taxes when you sign up for our payroll services, no fee’s will accrue

• If you add an additional state, the fee is $50 per state

• If you need to discontinue a state, the fee is $100 per state

Written by Harley VanDyke

Harley joined Superior Trucking Payroll Service (STPS) in early 2019. With nine years of customer service experience, she truly understands what it takes to make our clients happy. She loves working at STPS because of the family-like atmosphere. Harley’s favorite place to be is Traverse City, Michigan or anywhere that has hippos.

Contact Us!

Start-Up Trucking Company Payroll Help – No, You Are Not Too Small

Just Bought Your Second Truck? Now What? “How do I...

Read MoreWhat’s the Difference Between a Garnishment and a Friend of the Court (FOC) Order?

Have you ever looked at your paycheck and wondered, “Why...

Read MoreTrucking Payroll Tip: How To Handle Missing or Incorrect SSNs

What do you do if a truck driver gives you...

Read MoreDo You Have to Register for SUTA Before Running Your First Payroll?

Are you getting ready to pay your first employee? Not...

Read More