If you’ve ever bounced over a deep pothole in early...

Read MoreThere can be many components to determining a price for payroll services for your trucking company:

• Pay frequency (weekly, semiweekly, etc..)

• Number of employees

• Number of direct deposit accounts

• Number of third party checks like child support, tax levies or garnishments

• Number of W-2’s printed at year-end

• Number of local and state tax jurisdictions you withhold and remit to

• Do you need 401k reporting?

• Do you need workers comp reporting?

• Do you need AFLAC reporting?

Then there are fees for things that don’t happen with each payroll, like monthly and quarterly tax payments, quarterly tax filing of 941’s and state withholding and unemployment, W-2 printing and filing, 940 filings, and more.

With all these variables, there are many ways to get to a price. Some companies charge everything a la carte while others bundle it all into one rate.

We choose the letter option, with one rate for everything. It is easier to understand and there are no surprises at the end of a quarter or year. That is not to say that one rate is always less than the other but they often come out pretty close when you look at the total cost annually.

One of the keys to look at when comparing different quotes is to accurately assess the number of W-2s you’ll have at year-end. Just because you have 7 employees does not mean you will have 7 W-2s. 12 is more likely. You’ll want to make sure that gets properly quoted.

So how much do you charge for trucking payroll service?

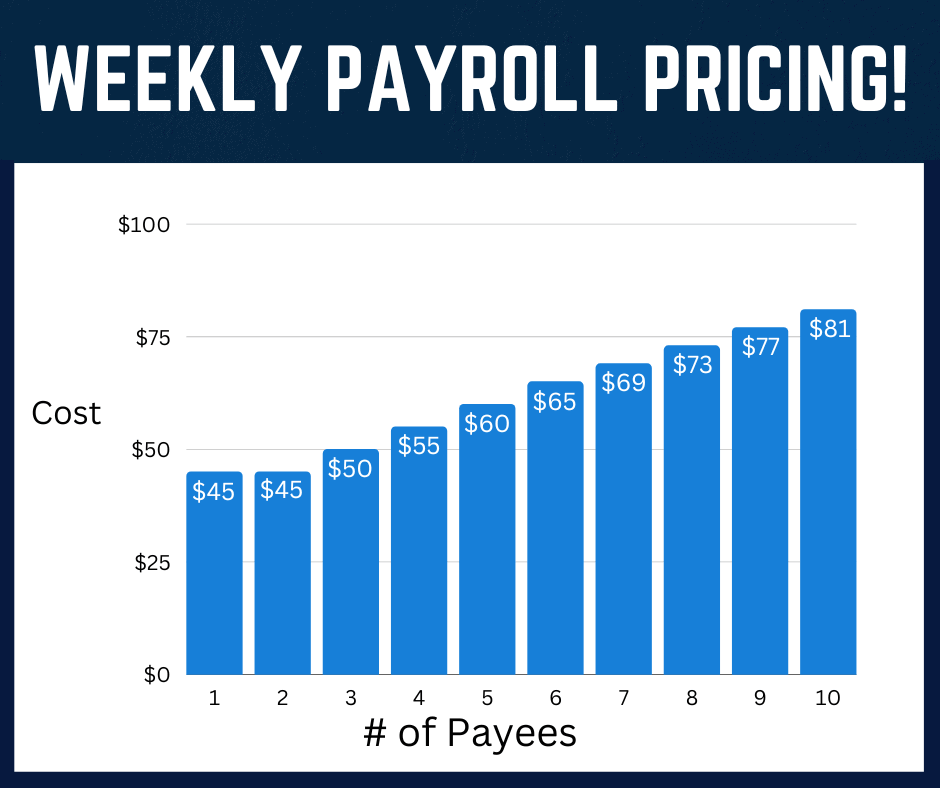

Our rates depend on the number of people you pay and how often. For a weekly payroll with ten employees or less, see the chart to the right. For more than ten employees, we like to talk to you first to get more information but the cost per pay gets less expensive as we pay more employees.

As mentioned earlier, that is all in so no surprises later. We don’t think your customers want a detention or lumper bill 3 months after delivery so we try to be the same way. That doesn’t make us less or more expensive than others. If you are shopping only on price, reach out to us and we will recommend someone else for you like Gusto or Intuit QuickBooks payroll. You’ll have to do more work but you will save money.

Written by Harley VanDyke

Harley joined Superior Trucking Payroll Service (STPS) in early 2019. With nine years of customer service experience, she truly understands what it takes to make our clients happy. She loves working at STPS because of the family-like atmosphere. Harley’s favorite place to be is Traverse City, Michigan or anywhere that has hippos.

Contact Us!

Is Superior Trucking Payroll Service Worth the Higher Cost?

You’re Not Just Buying Payroll — You’re Buying Peace of...

Read MorePayroll for Trucking Companies: We Help Your Whole Trucking Family Get Paid

If you’ve heard of Superior Trucking Payroll Service, you’ve probably...

Read MoreHow Do I Pay Myself If My LLC Is an S-Corp or C-Corp?

How do I pay myself if my LLC is taxed...

Read MoreMarch 2025 Driver Pay Update for Trucking Companies

Are your drivers leaving for better pay? Are you wondering...

Read More